empirica housing market forecasts: demographic trends up to 2045

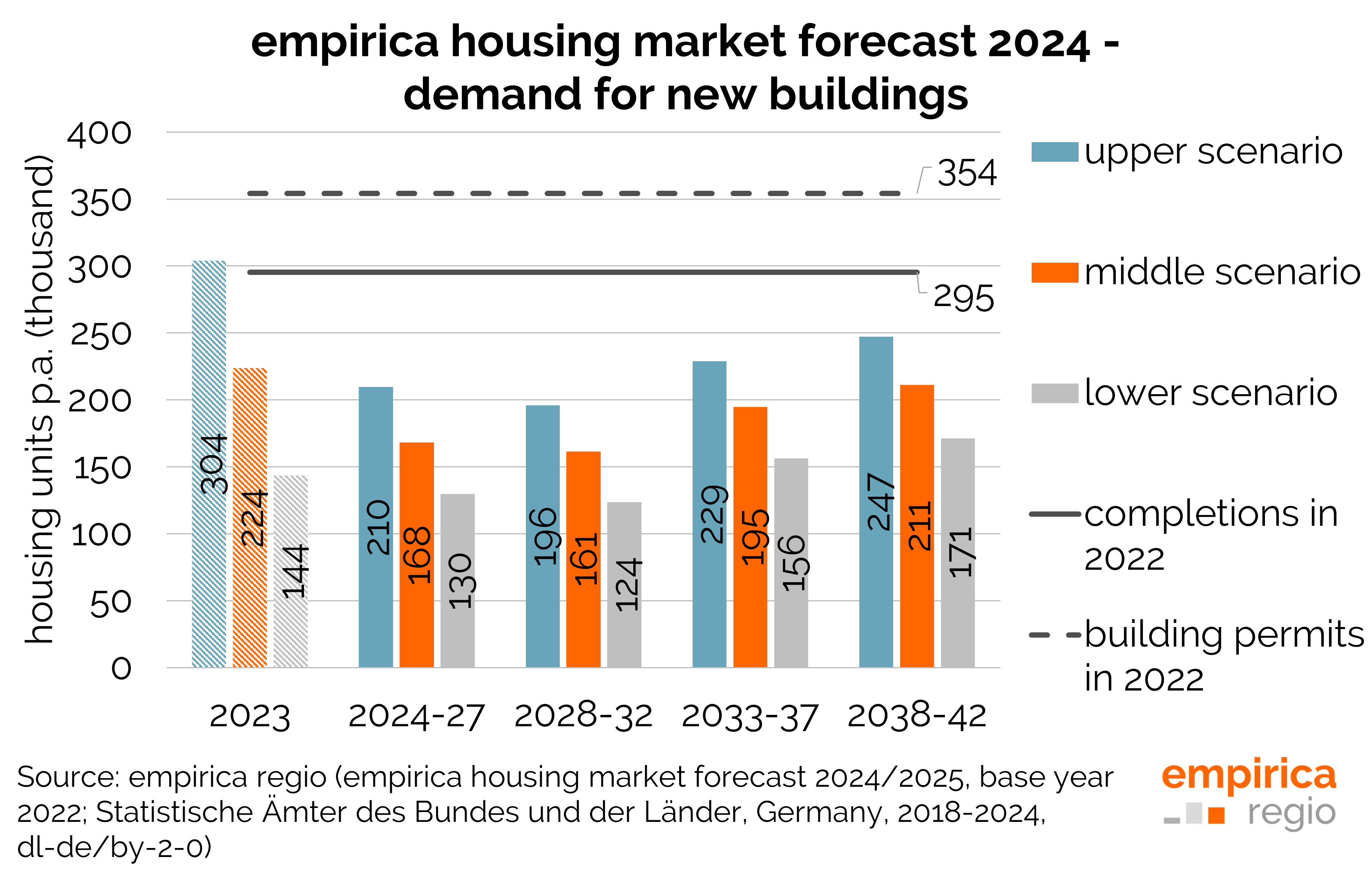

The new empirica housing market forecasts show the demographic trends in the German housing market until 2045. If immigration to Germany does not significantly decrease, then the population will continue to rise. The empirica demand forecast shows an annual new construction demand of around 170 thousand apartments for the period 2024-27. After that, demand decreases somewhat, but in the mid-2030s there will be a small demographic upheaval, causing demand from older households to rise again.

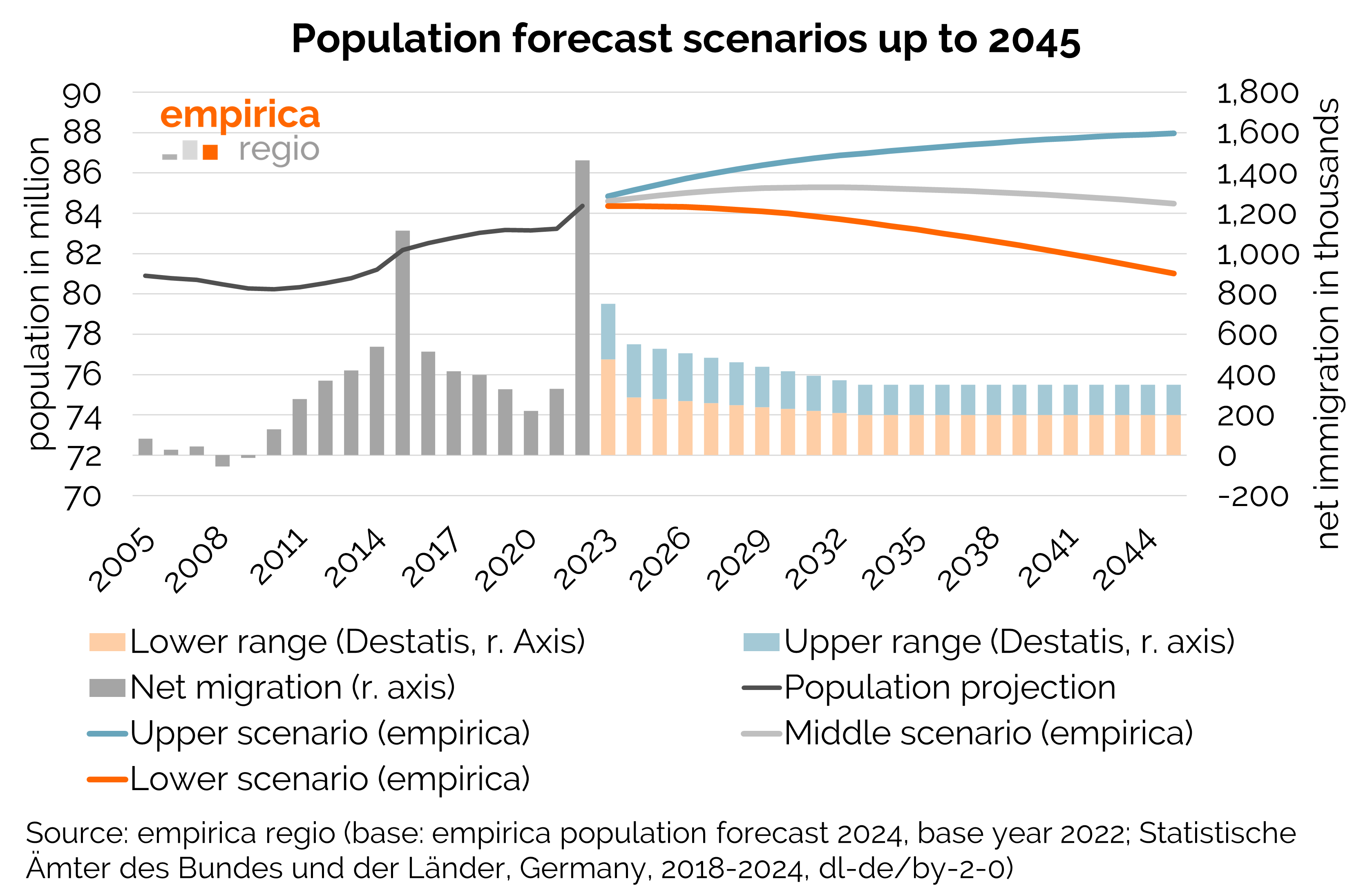

The population forecast is divided into three basic scenarios (upper, middle and lower variant) and shows the population development until 2045 at the district and municipal level. Thus, the new data also allow statements about the long-term demographic development in Germany and the development of long-term demand cycles. In the current empirica forecast, no separate scenario is calculated for Ukraine anymore, because the upper variant serves for the consideration of a scenario with increased immigration. The population rises in the upper scenario to 88 million people, remains stable in the middle scenario and decreases in the lower scenario to 81 million by 2045.

No stable population development without immigration

All three scenarios assume a significantly increased immigration at the beginning of the forecast and a decrease in immigration numbers to a constant level from 2033 onwards. In fact, there is likely to be further cyclical immigration as a result of refugee movements in the long term, so that a decrease in immigration, as depicted in the lower variant, is unlikely. The forecast shows that without steady immigration, the nationwide population development becomes negative, even in the middle scenario of the forecast.

Further important results of the population forecast: The gradient between west and east as well as north and south will continue to increase. Regions with a sustained population growth are mainly found in Baden-Württemberg and Bavaria, in the Rhine-Main area, the Rhine axis, in northwest Lower Saxony as well as in the surrounding areas of Hamburg and Berlin. But even in these regions, the middle scenario will lead to a decrease in population dynamics in the 2030s. In contrast, according to the forecast, many districts in East Germany as well as in some West German regions such as southern Lower Saxony, northern Hesse, southeastern North Rhine-Westphalia or southern Rhineland-Palatinate and Saarland will shrink in the coming years.

“Too much” and “too little” new construction

In the period 2024 to 2027, the new construction demand, which results from the demographic change of the population, lies between 130 thousand housing units per year in the lower scenario and 210 thousand housing units per year in the upper scenario. Even if a decrease in the population at the federal level is forecast, the demand for new construction will likely increase slightly again in the 2030s. This is due to an increasing qualitative additional demand (e.g., age-appropriate living), regional differences in population and household development, and demographic changes. In particular, in growing regions, demand will increase more than in previous years. In the long term, an increasing number of older people is to be expected, which leads to a higher number of households given a certain population.

When comparing the new construction demand forecast with the completions in 2022, it seems as if too much is being built or as if the demand for additional apartments is much lower than often claimed. However, the nationwide figures should be interpreted with caution. Because when the figures are differentiated regionally, both regions where “too much” is being built and regions where “too little” is being built are shown. Estimates by empirica show that about 115 thousand apartments or more than a third of the new construction activity in 2022 took place “in the wrong place”. There are two main reasons for this. First: Where demand is particularly high, there is no or too little building land available. This leads to stronger suburbanization with a shift of the new construction activity to the surrounding areas of the big cities. Second: New construction takes place where the preferences of the households cannot be realized in the existing stock, e.g. due to a lack of modernization of older apartments. Quantitatively, these apartments are not needed and lead to additional vacancies.

Data bases and methodology

The empirica population forecast 2024 with the base year 2022 forms the basis for all forecasts. On this basis, empirica has created a forecast for households, also with the base year 2022. After subtenant households have been deducted and the demand for second homes has been added, the number of households demanding apartments results. The increasing number of households demanding apartments and houses shows the additional demand for housing units, which is caused by changes in the population, the size of households and the age distribution of households. In general, the more inhabitants there are, the more apartments are demanded. Larger households tend to demand single/two-family houses, while older households, which are usually smaller households, tend to demand apartments in multi-storey buildings.

Detailed results and further information on the methodology can be found in a current publication, which is available for download on the website of empirica ag (in German only):

Download (extern): empirica-Paper Nr. 272