June 12, 2025

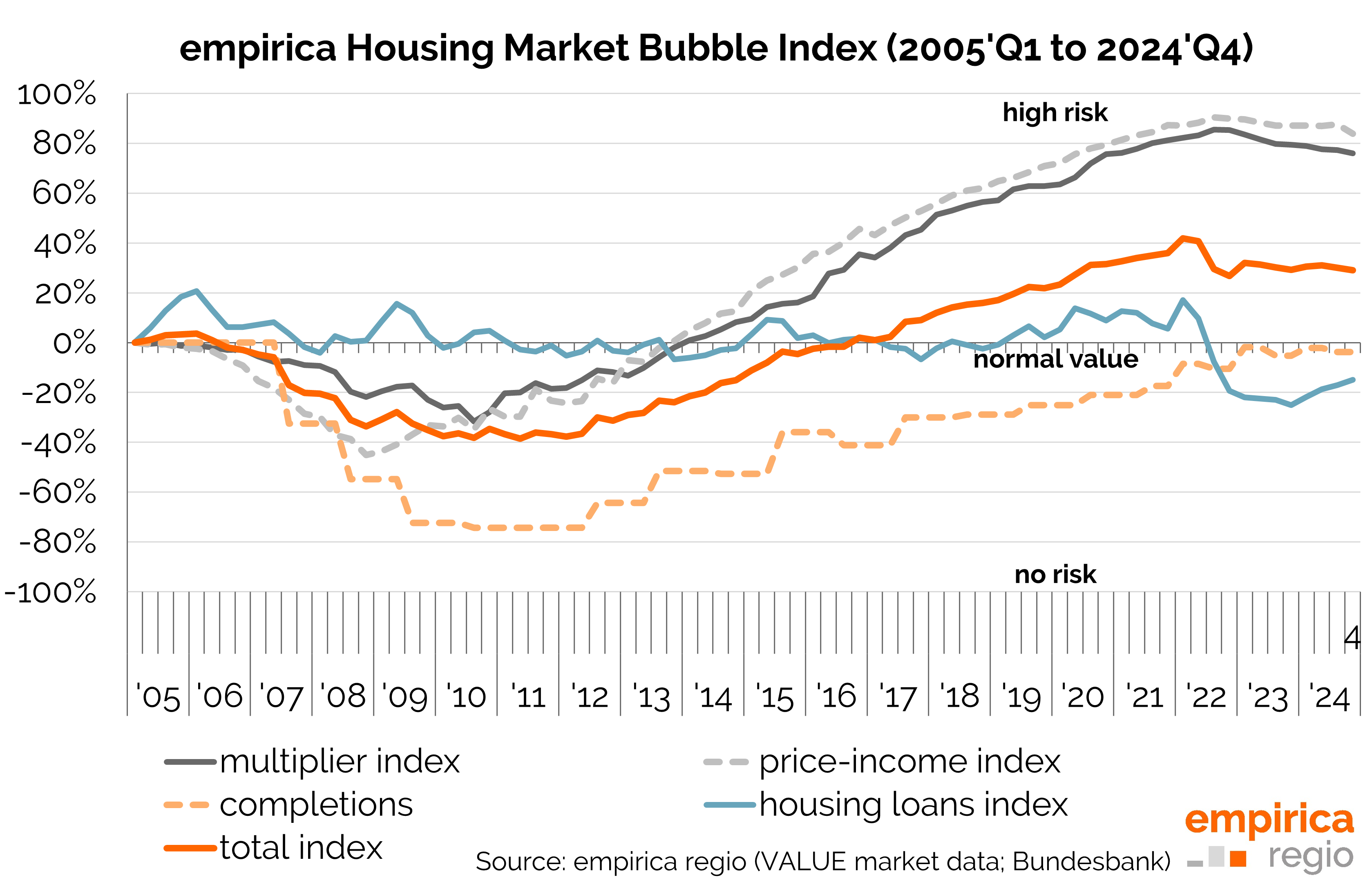

Housing bubble index Q1/2025: Spread of bubble risk stagnates, but explosiveness continues to fall

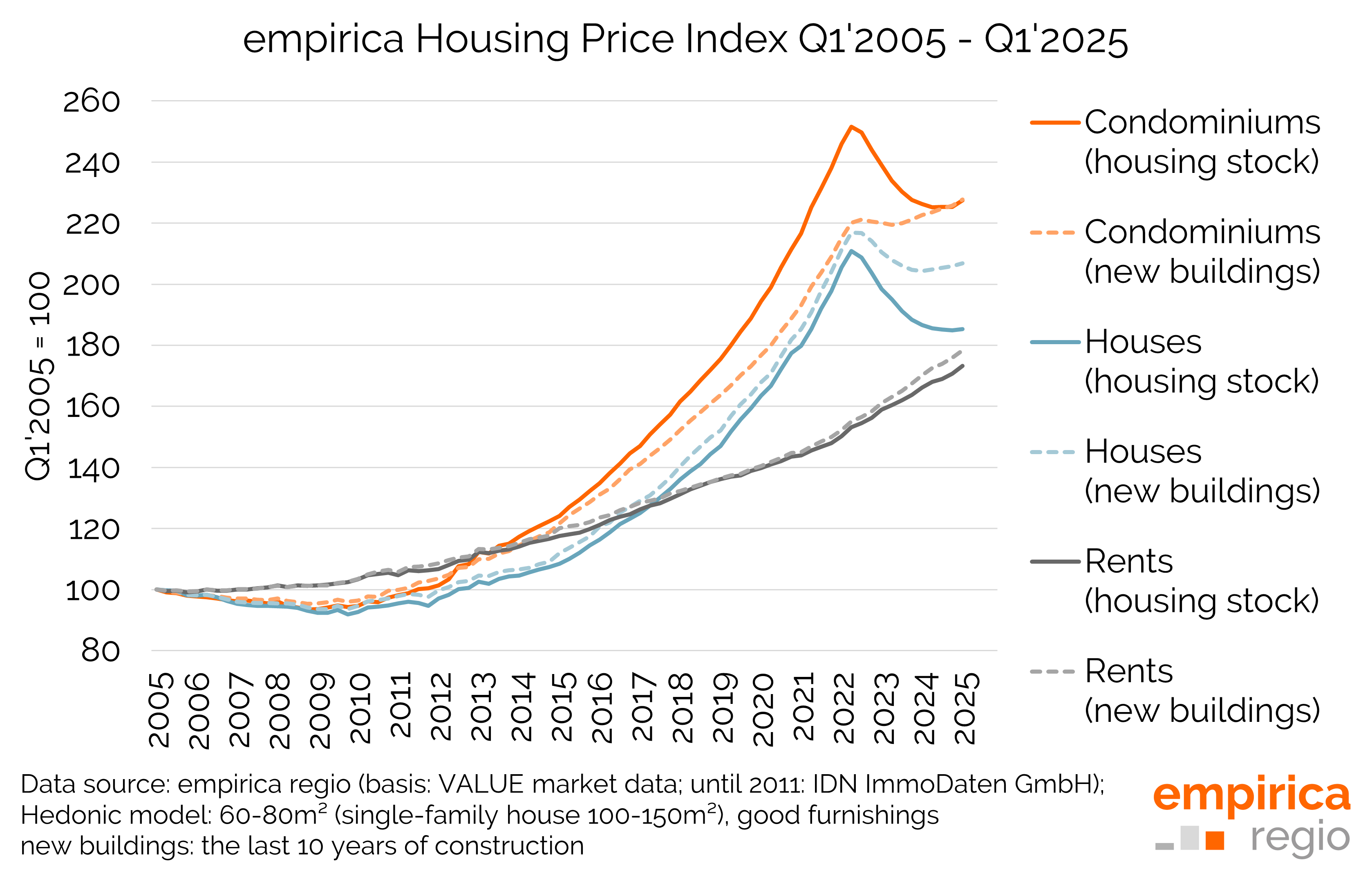

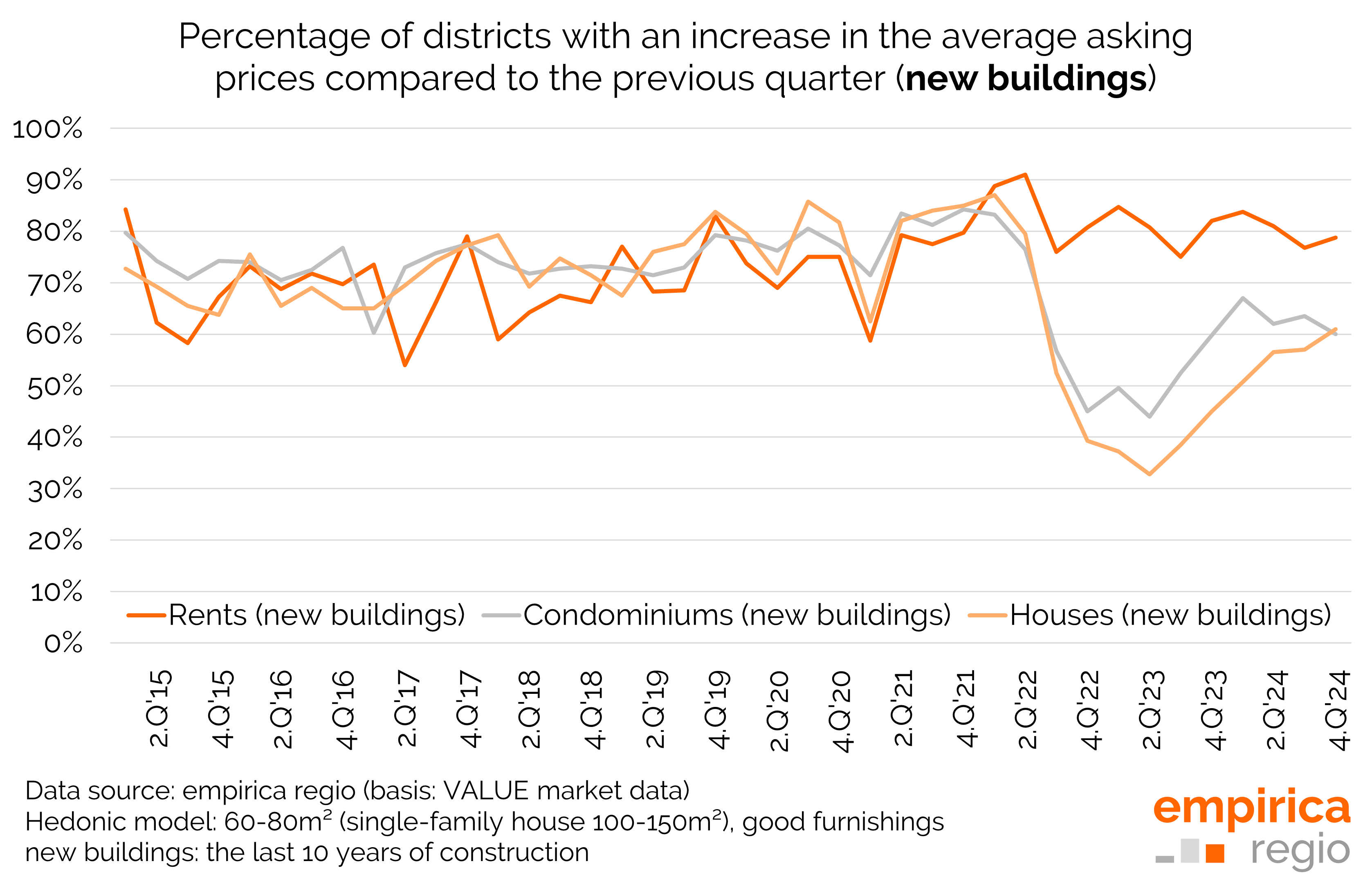

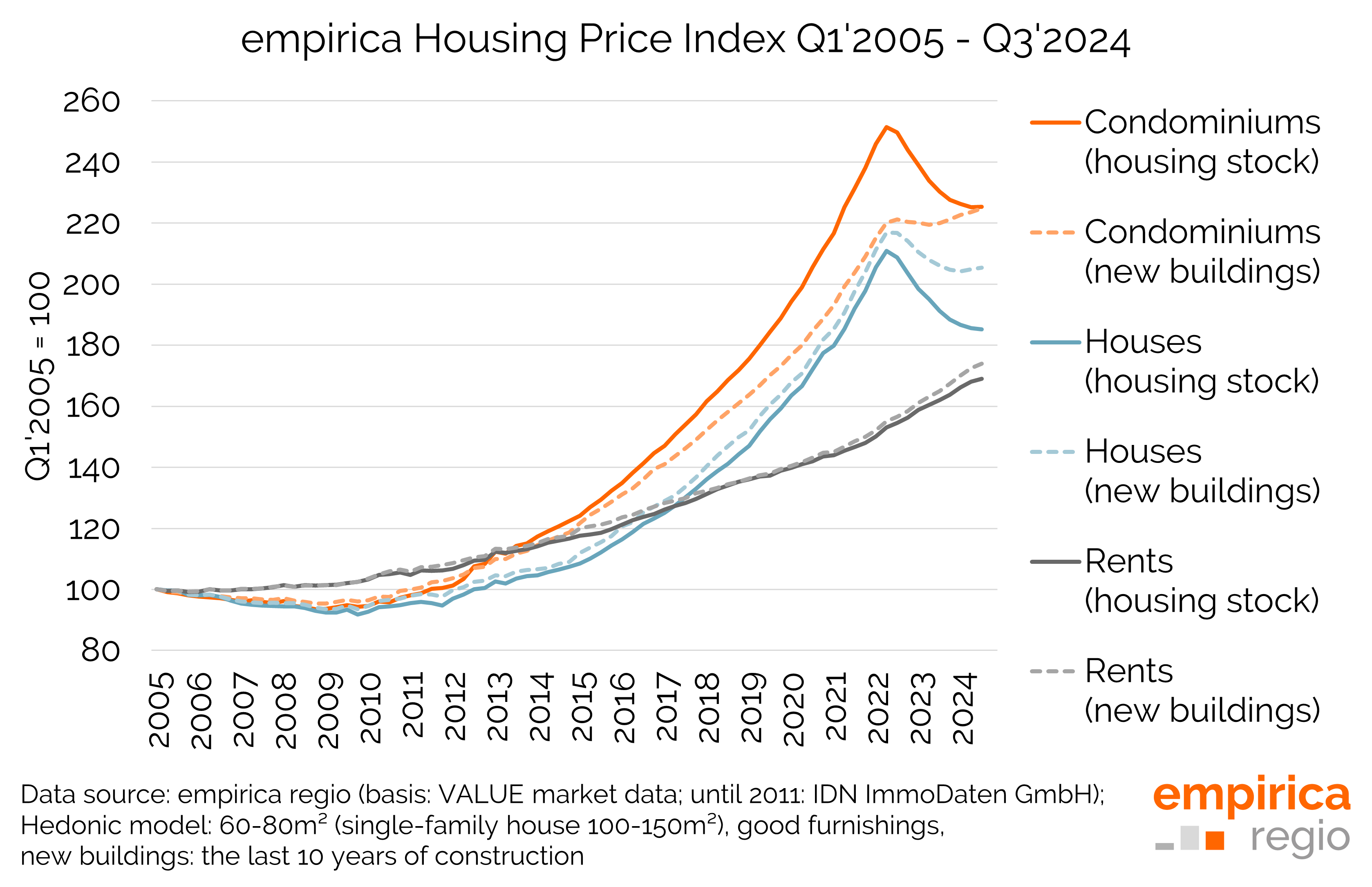

When rents rise faster than purchase prices, it gives hope to many who dream of owning their own home. This is because buying owner-occupied property is then more worthwhile than renting. At the same time, this trend acts as a safety net for the property market: the more rents catch up with purchase prices, the lower the risk of a price collapse - the risk of a bubble decreases.