New Real Estate Market Data Available

The empirica housing price index with current rents and purchase prices for the 4th quarter of 2020 and the CBRE-empirica-Vacancy-Index 2020 are available.

empirica Real Estate Price Index Q4 2020

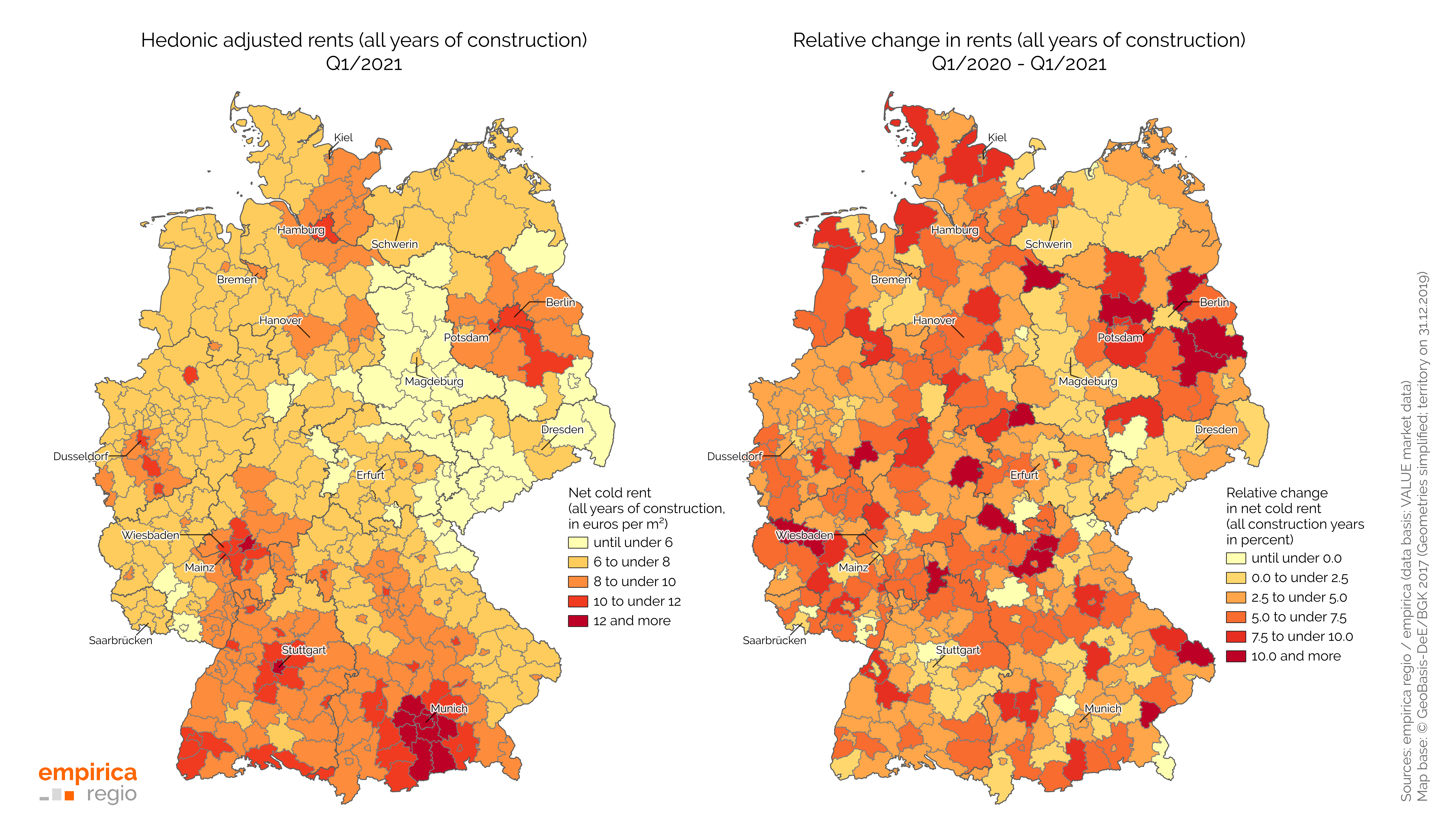

The current empirica real estate price index for Q4/2020 is now available. The indices for rental flats, owner-occupied flats and detached and semi-detached houses continue to rise, with purchase prices also continuing to rise more strongly than rents. The current analysis by empirica also shows, however, that conditions in the existing rental segment have changed somewhat over the past two years. In relation to the average in Germany, rents in the cities rose more strongly until 2018 and the districts, on the other hand, developed below average. Since 2018, this trend has reversed, with rents in the districts rising at an above-average rate and those in the independent cities at a below-average rate. The negative development of rents in existing buildings in Berlin plays a role in this, but the development of rents in existing apartment buildings in other major cities has also slowed down recently.

The determination of hedonic prices is a procedure that better takes into account changes in quality (furnishings, flat size, age of construction, etc.). This is necessary because the respective advertised housing supply can differ from quarter to quarter. The hedonics used here is based on a bottom-up approach that aggregates from 401 regressions at the district level to regional, state and national values.

How are Vacancies Developing in Multi-Storey Housing?

Shortly before Christmas, the <a href=“https://www.empirica-institut.de/nachrichten/details/nachricht/cbre-empirica-leerstandsindex-2020/" alt=“CBRE-empirica-Vacancy-Index 2020 - Market Active Vacancy for Districts”” target="_blank">CBRE-empirica-Vacancy-Index was published with the vacancy rates as at 31 December 2019. For the first time in 13 years, the vacancy rate nationwide has stagnated at 2.8% or around 603,000 flats. Although the vacancy rate continues to fall in the growth regions, it is also rising again in the shrinking regions. In the swarm cities, on the other hand, the vacancy reserves have been exhausted, so a further drop in vacancy rates is hardly possible.

The CBRE-empirica-vacancy-index is the only data source with information on the market-active vacancy rate in multi-storey flats in Germany. The current figures are based on management data from the real estate consultancy CBRE (around 733,000 residential units) as well as extensive analyses and estimates based on the empirica regional database and the Federal Statistical Office.

How to Get Our Data

Our clients receive the current data of the empirica property price index and the CBRE-empirica-vacancy-index via the market studio. The empirica regio Housing Market Reports also contain the most up-to-date data. Contact us for further information. The methods and data basis for the price index and the vacancy index as well as further data sets can also be found on the website of empirica ag.