Property tax B in Top-7 unchanged - Lorch (Rheingau) increases property tax by 365 percent

empirica regio has aggregated, adjusted and analysed property tax data from the federal states and the federal government. The data are always published by the statistical offices with a delay of approximately one year.

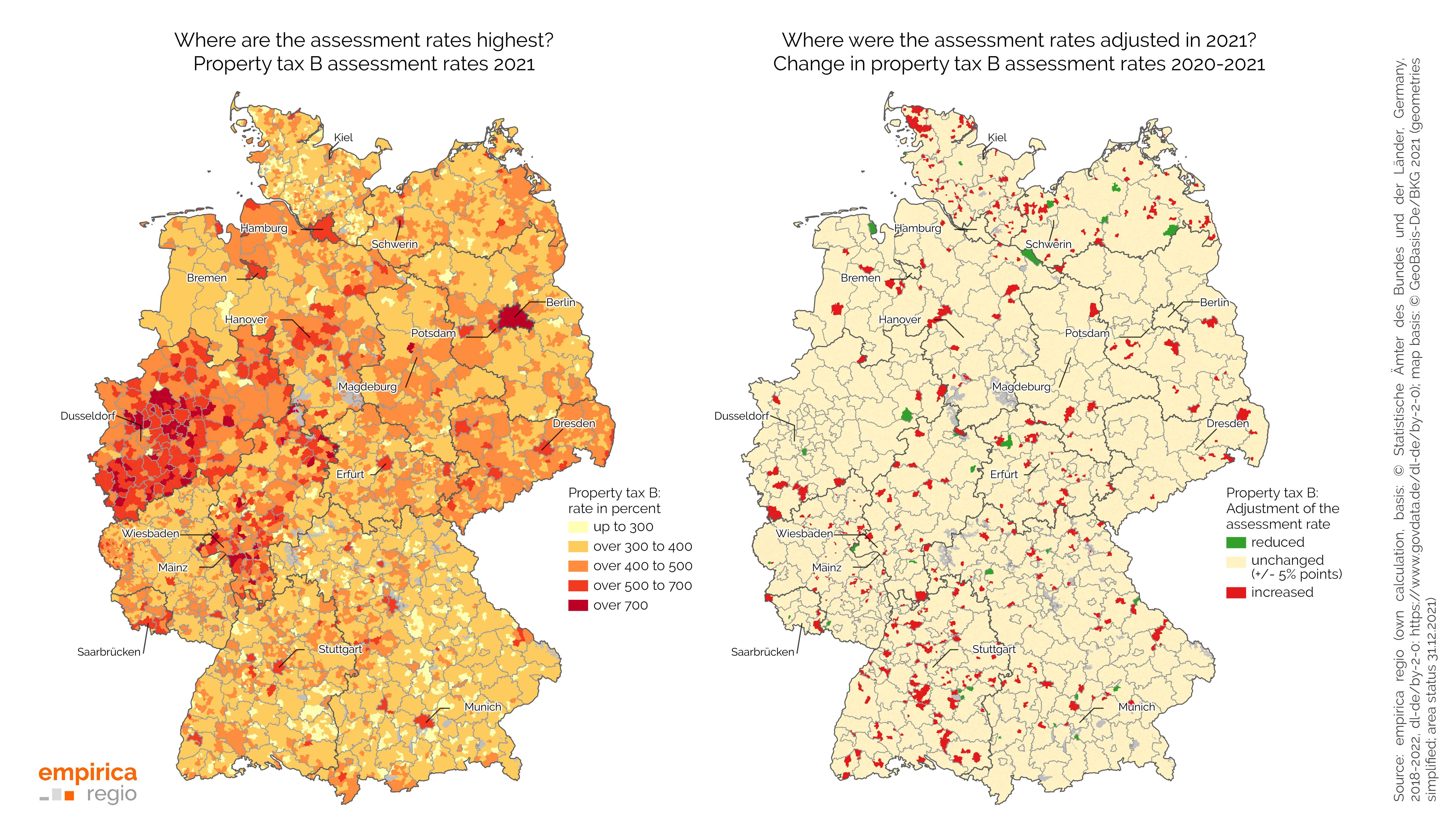

The most important results: Across Germany, property owners in Lautertal (Odenwald) and in Lorch (Rheingau) are burdened the most with an assessment rate of 1,050 percent. Lorch was flushed into first place by its 365 percentage point increase in the B property tax. Nauheim and Ringgau share second place with 960 percent, followed by Bergneustadt (959 %) and Bad Karlshafen (951 %). The large city of Offenbach am Main, on the other hand, reduced its property tax by 100 percentage points and thus falls eleven places to 13th place. In total, there are 910 municipalities in which the assessment rate increased by at least 5 percentage points from 2020 to 2021, 217 of which with an increase of 50 or more percentage points. In 108 municipalities, the assessment rate fell by 5 or more percentage points, 21 municipalities lowered by at least 50 percentage points.

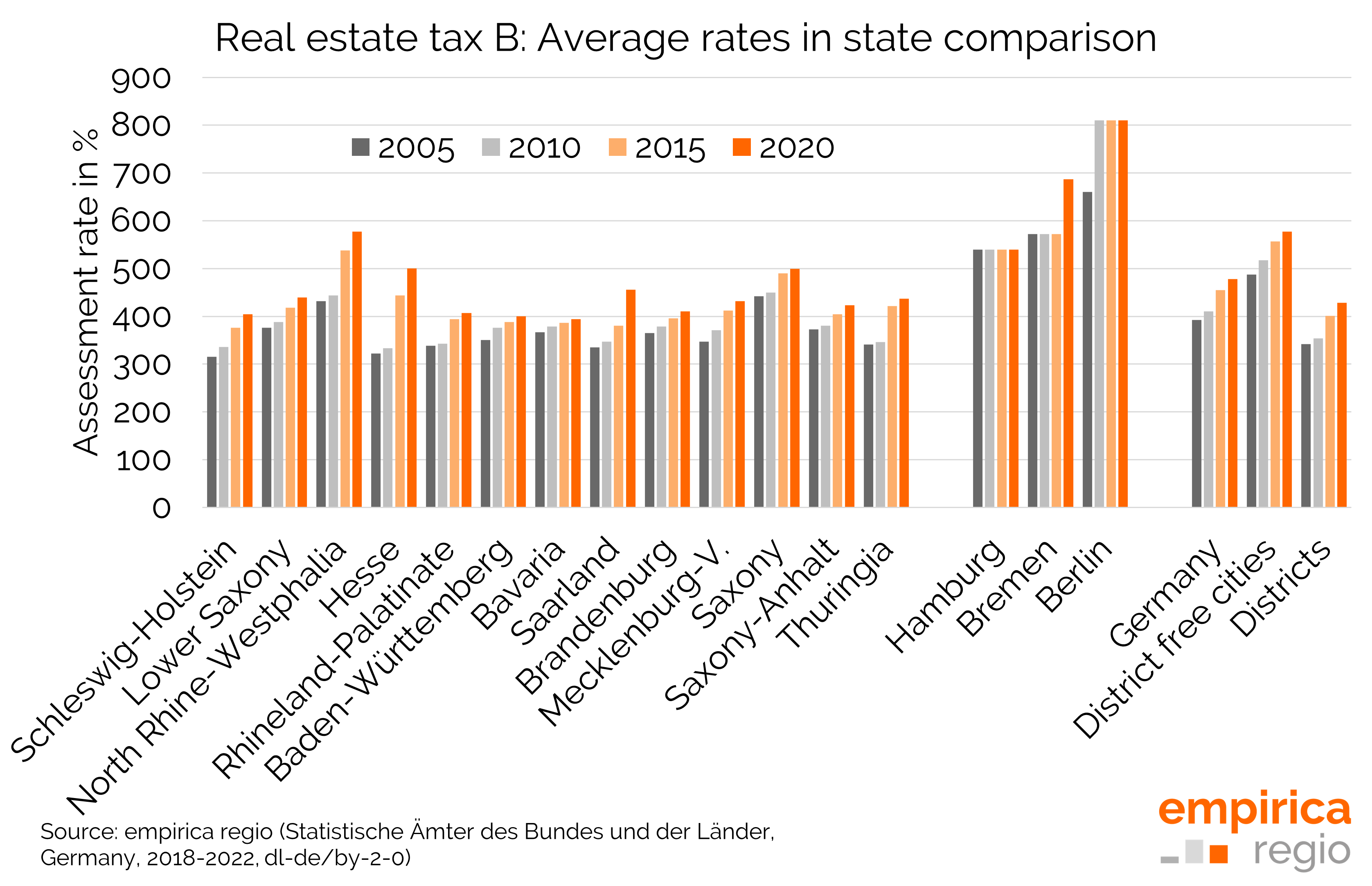

In the big cities, on the other hand, property tax reached a plateau, with values at a medium level. The range of assessment rates thus extended from 440 percent in Düsseldorf to 500 percent in Frankfurt am Main, 515 percent in Cologne, 520 percent in Stuttgart, 535 percent in Munich and 540 percent in Hamburg. Berlin is the lone front-runner with an above-average assessment rate of 810 per cent, which also raises the average assessment rate of the top 7 cities to 591 per cent.

Tax rates highest in the Ruhr region and in Berlin

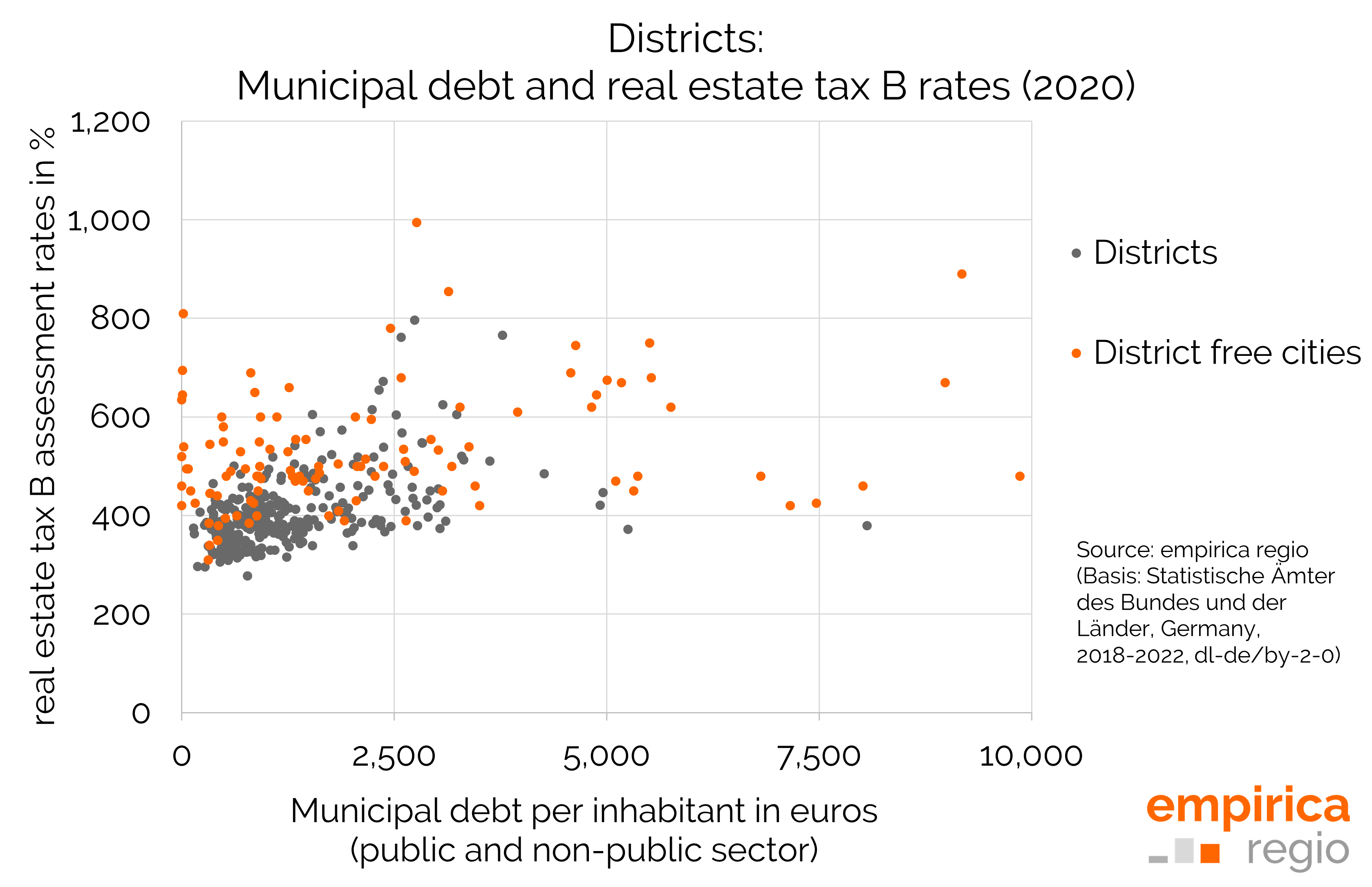

The analysis: There is a correlation between property tax and the debt per capita of a municipality. Factors such as population and property price growth, on the other hand, did not play a role. The assessment rates are highest in the Rhine-Ruhr transformation region and in Berlin. Looking at the adjustments, a mixed picture emerges; in addition to numerous adjustments in the north-east, it is particularly noticeable that adjustments in Bavaria were very limited.

As in previous years, the 71 residents of the municipality of Christinenthal in Schleswig-Holstein pay the lowest assessment rates (45 %). They are followed by Ingelheim am Rhein (80 %), Dammfleth and Elisabeth-Sophien-Koog (both 100 %).

Low property tax in Schleswig-Holstein

The lowest assessment rates for property tax are found in Schleswig-Holstein, especially in rural areas. However, even wealthy urban municipalities still offer extraordinarily low assessment rates in some cases. In some cases, directly neighbouring municipalities have only a fraction of the assessment rates.

For example, the headquarters of the German Stock Exchange in Eschborn, just outside Frankfurt, is still within the range of the ten lowest assessment rates in Germany with an assessment rate of 140 per cent and is thus also significantly cheaper than Frankfurt’s core city.