Housing market data Q1/2022: Indices continue to rise (again)

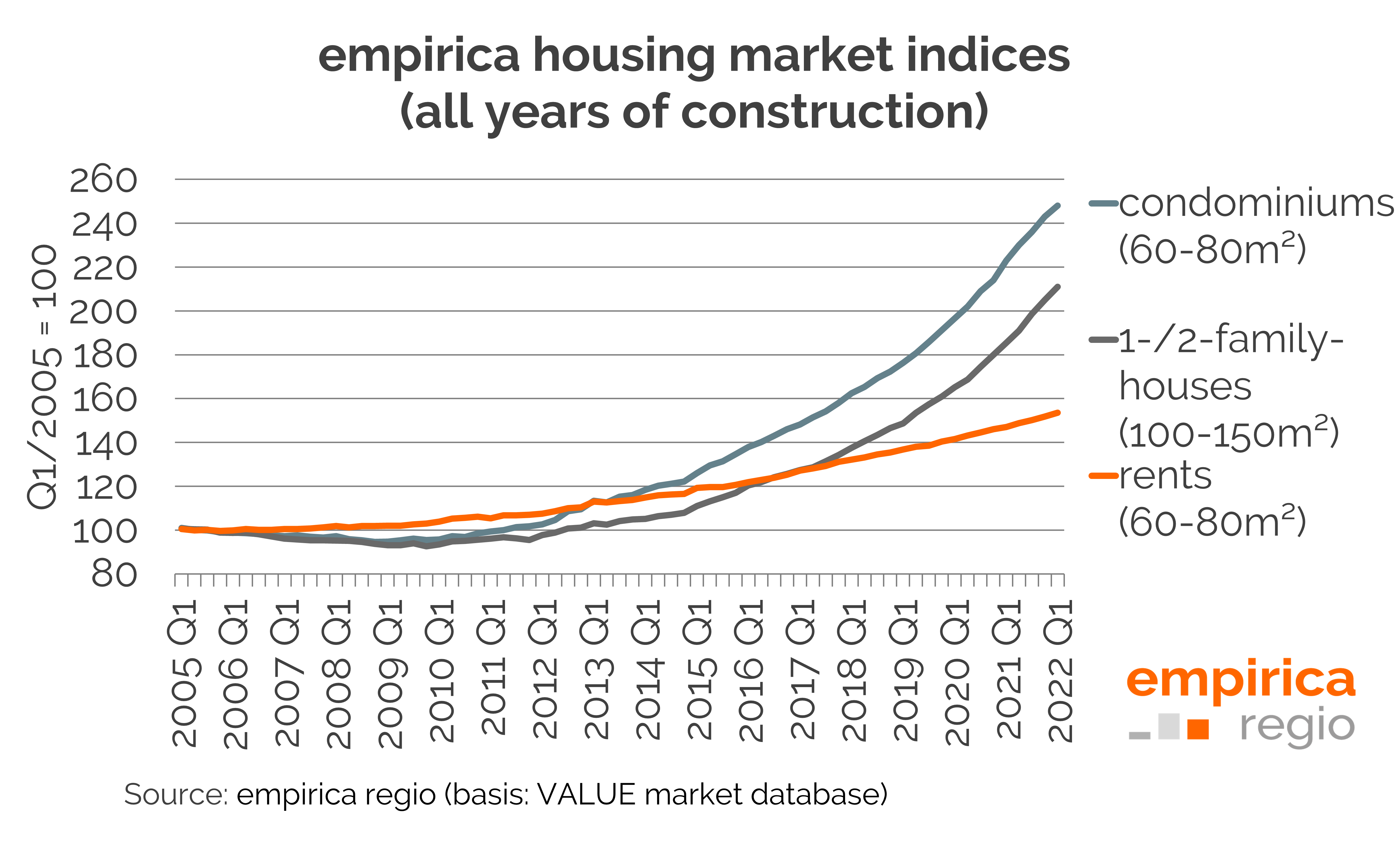

We have written this sentence in this or similar form many times in recent quarters: The indices for the rental, condominium and detached and semi-detached house sub-segments continued to rise in Q1/2022. The relative increase in advertised rents, at 1.2% compared to the last quarter, continued to lag well behind the development of purchase prices. Prices for condominiums rose by 2.4% compared to Q4, prices for detached and semi-detached houses even by 3.1% compared to the last quarter.

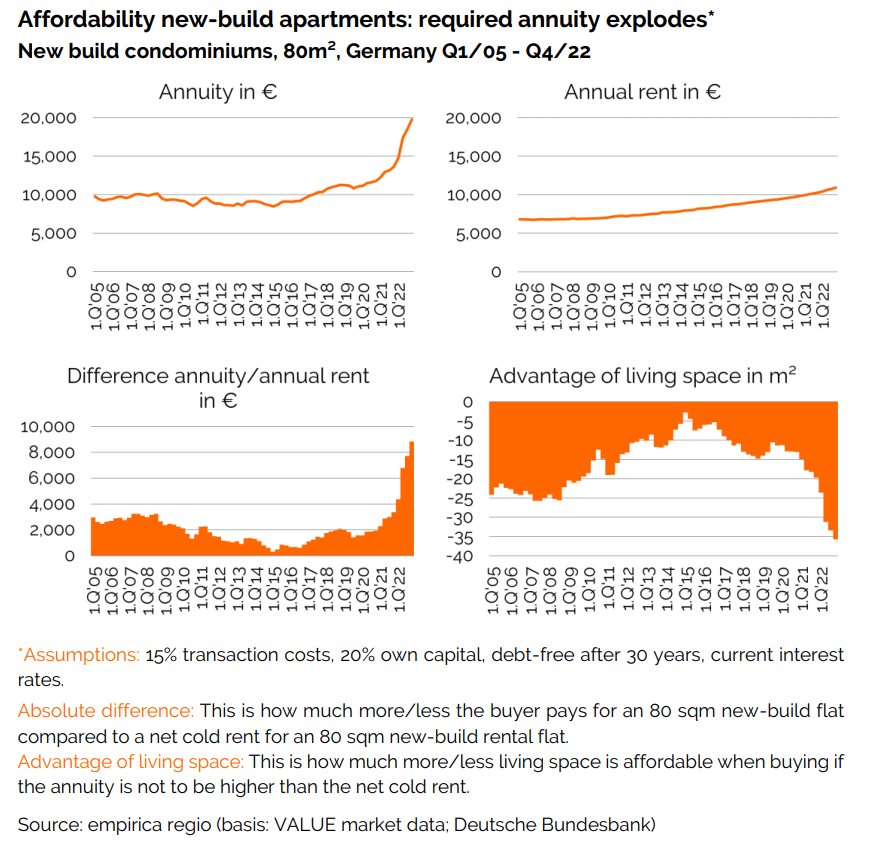

The purchase price rally could end with the upcoming interest rate increase. But: staff and material bottlenecks, rising inflation and a lack of housing supply in tight housing markets still seem to be driving the purchase price rally at the moment. Shortages also continue to drive up rents. New construction would help here, of which there is theoretically already enough, but often in the wrong place, as the empirica housing market forecast shows. To enable you to compare price trends, demographic factors and forecasts, you will find all the relevant data on this in the empirica regional database.