CBRE-empirica-Vacancy-Index 2022

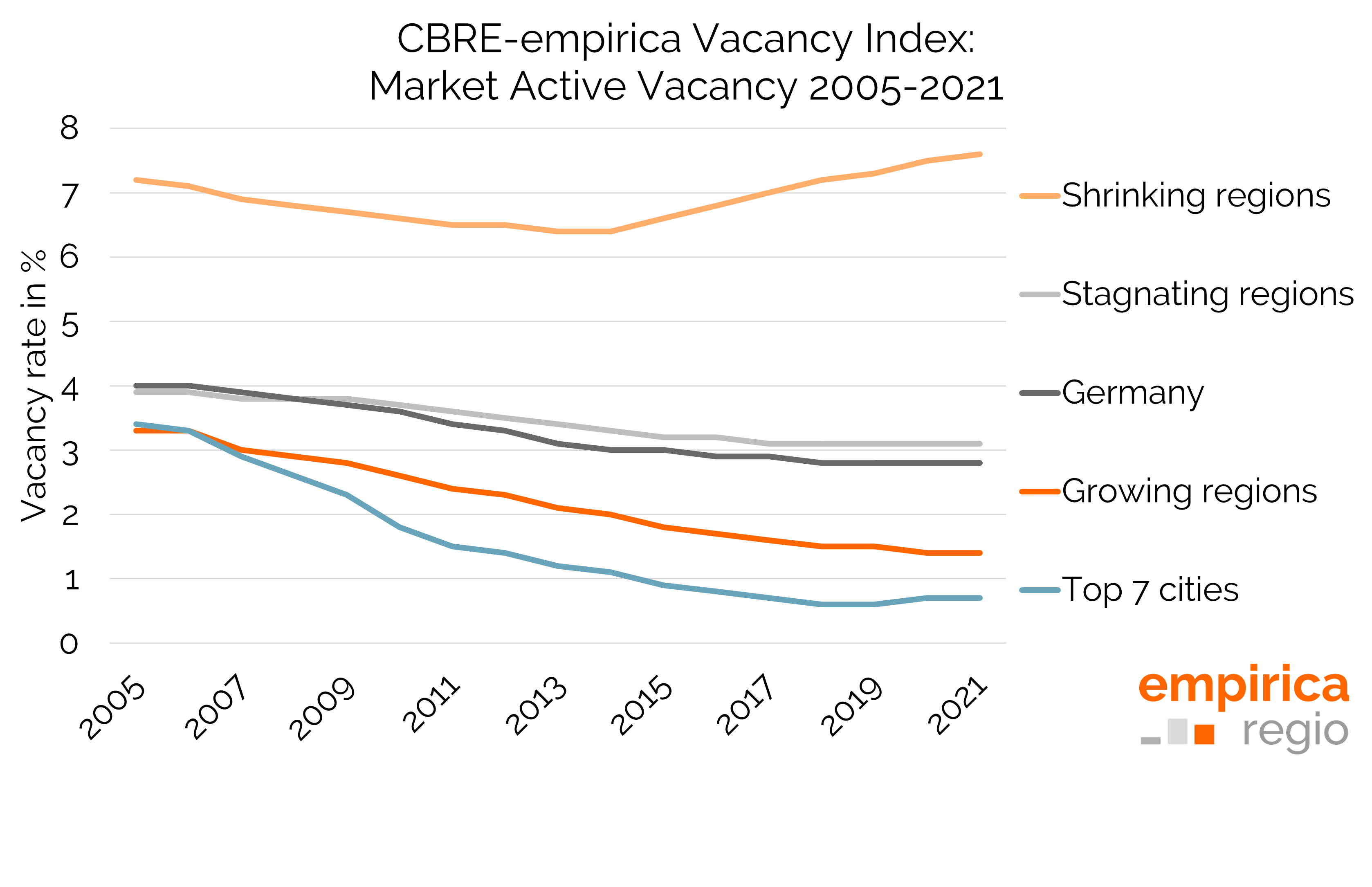

According to the CBRE-empirica Vacancy Index, the market-active vacancy rate - i.e. flats that can be let immediately or activated in the medium term - was 2.8 percent or around 607,000 units at the end of 2021. This means that the vacancy rate has reduced by about 4 thousand units compared to the previous year.

The market-active vacancy rate in eastern Germany (excluding Berlin) remains significantly higher at 6.2 percent than in the west at 2.1 percent. But even in the west there are regions with high vacancy rates and a shrinking population. The divergent developments in regions with shrinking and growing populations are therefore more significant. In shrinking regions, the vacancy rate continues to rise and is currently 7.4 percent. In contrast, the vacancy rate in growth regions is only below average at 1.4 percent and is thus far from a balanced housing market. The lowest vacancy rates are currently found in the city of Munich (0.2 percent), followed by Frankfurt am Main, Münster, Freiburg (0.3 percent each) and Ingolstadt (0.4 percent). At the upper end of the scale are Pirmasens (9.3 percent) and Frankfurt/Oder (9.1 percent) as well as Chemnitz (9.0 percent).

The CBRE-empirica-vacancy-index is the only data source with information on the market-active vacancy rate in multi-storey flats in Germany. The current figures are based on management data from the real estate consultancy CBRE (Around 920,000 residential units as of 31.12.2021) as well as extensive analyses and estimates based on the empirica regional database and the Federal Statistical Office.

Our clients receive the current data of the empirica property price index and the CBRE-empirica-vacancy-index via the market studio. The empirica regio Housing Market Reports also contain the most up-to-date data. Contact us for further information. The methods and data basis for the price index and the vacancy index as well as further data sets can also be found on the website of empirica ag .