empirica Real Estate Price Index Q3 2020

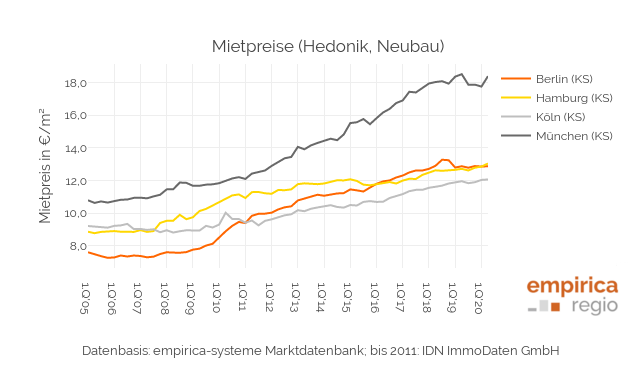

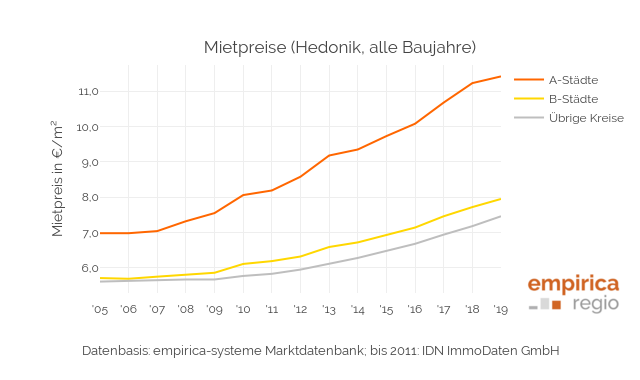

The current empirica property price index for Q3/2020 is now available. The indices for rented and owner-occupied flats as well as single and two-family houses continue to rise across all construction years.

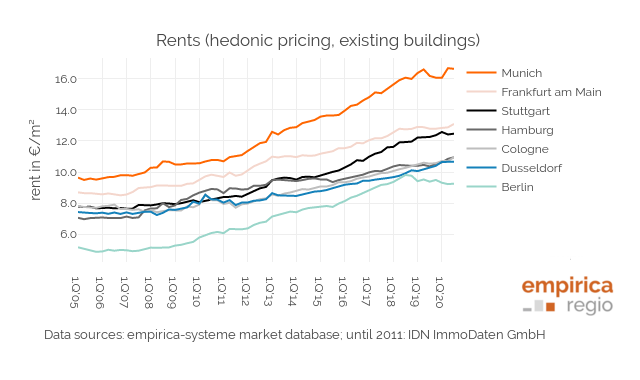

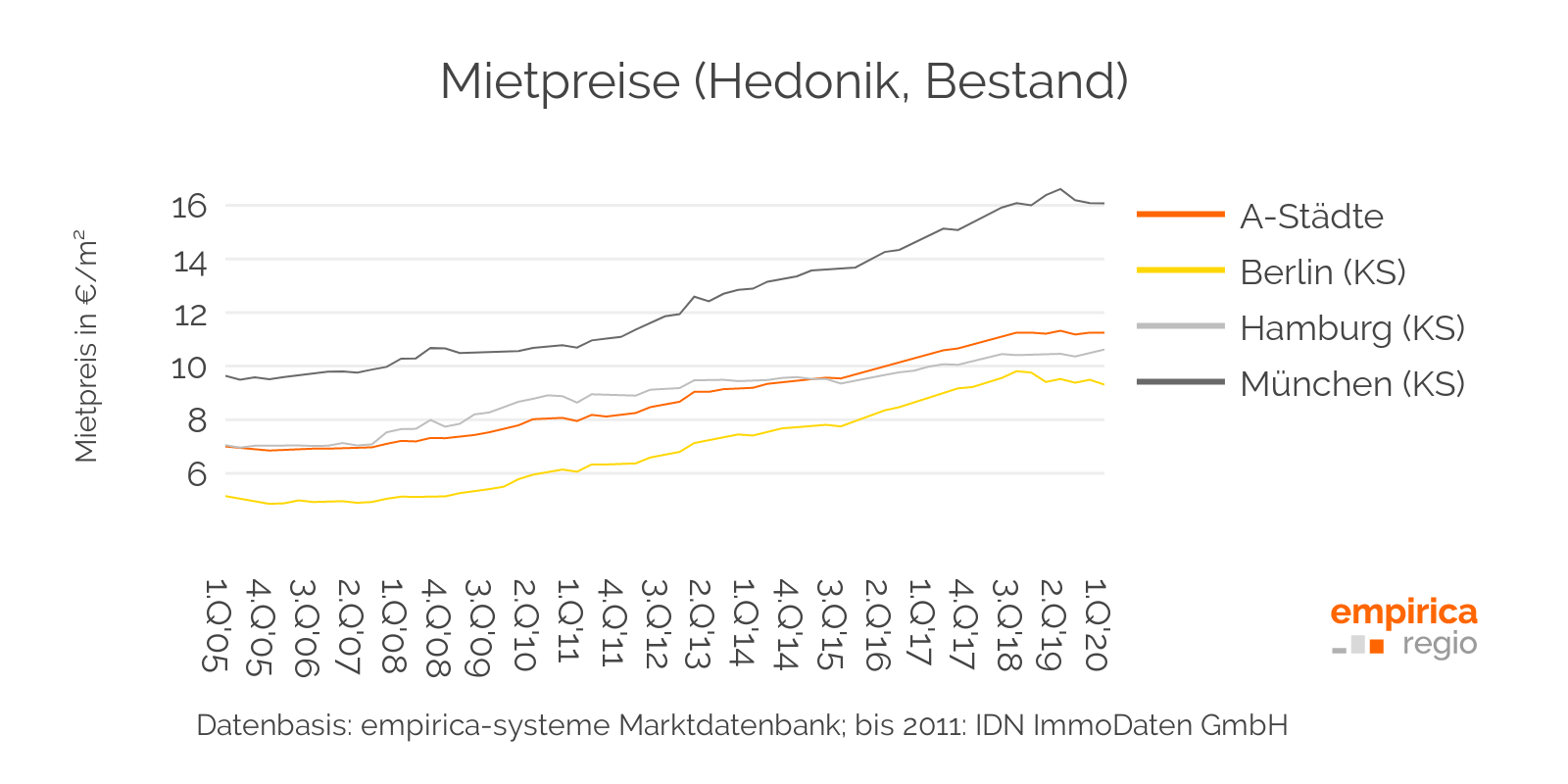

It is still the case that rents rise significantly weaker (+1.0%) than purchase prices (ETW and EZFH each +3.5%). In the current report on the index (in German) the indices for the new construction segments are already presented in detail. For the current quarter, we therefore take a brief look at rents for existing apartments for the top 7 cities and in particular for Berlin. The data presented here refers to hedonically adjusted rents for new tenants moving into a 60-80m² flat with upscale fittings and with a construction year up to a maximum of 10 years prior to the quarter presented.

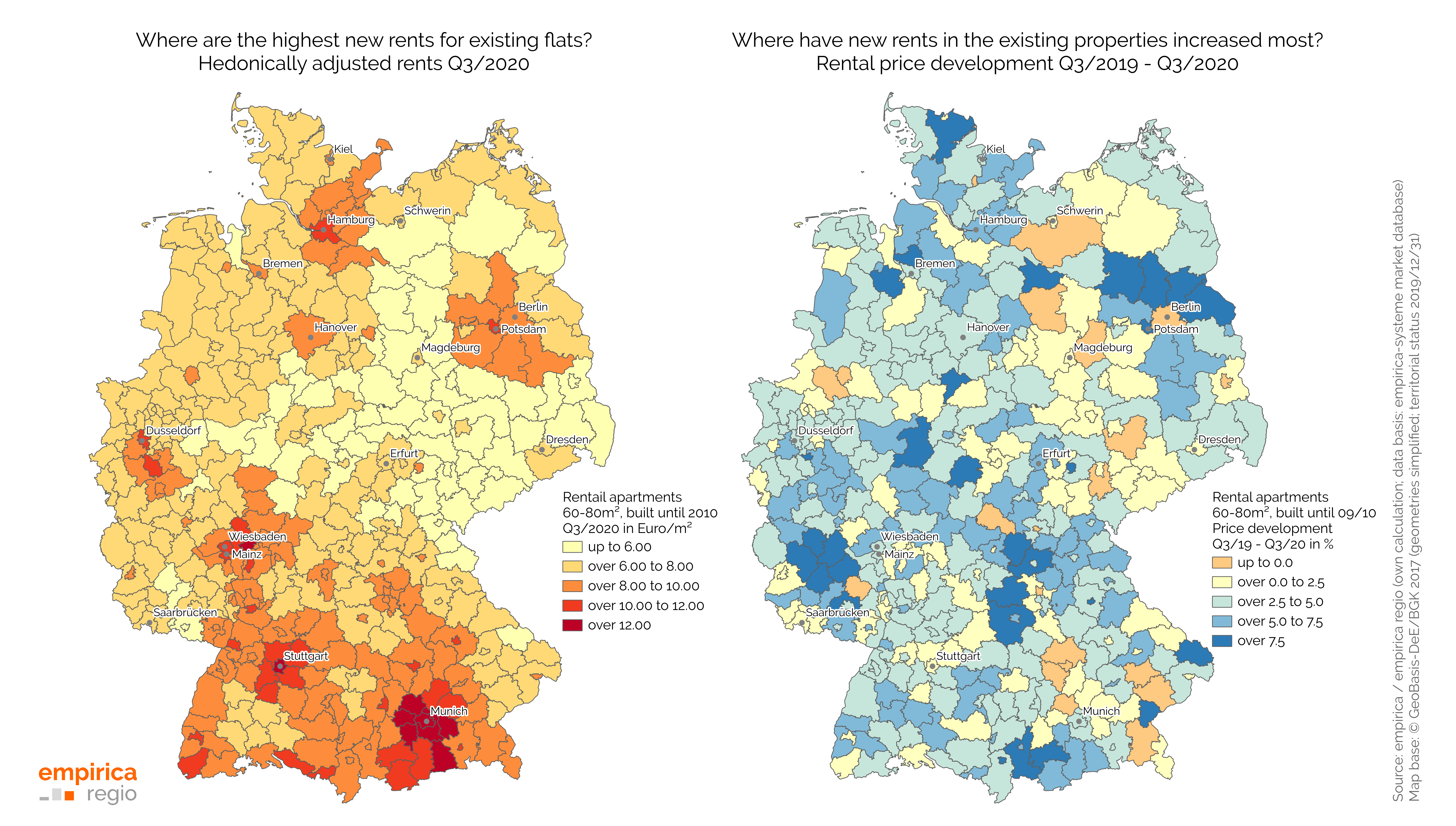

In the top 7 cities, with the exception of Berlin, rents in existing properties have risen between 1.7% (Stuttgart) and 5.7% (Hamburg) since Q3/2019. In Berlin, however, average rents fell by -1.4% over the same period. In Frankfurt am Main and especially in Munich, as the following graph shows, there was at least one “price dip” between Q2/2019 and Q2/2020. Compared to Germany as a whole (+3.4% since Q3/2020), only in Düsseldorf, Cologne and Hamburg is the relative price increase currently higher. The following map shows the current price levels for new rental contracts in existing flats as well as the relative development since the same quarter of the previous year for all districts and district-free cities.

How are rents in Berlin developing?

Since Q3/2018, the average Berlin rents for residential properties in the portfolio have fallen or stagnated with slight fluctuations in the property price index. As the properties shown here refer to the years of construction up to 2010 at the most, these flats are also covered by the rent cap (where the exceptions are new constructions from 2014/1/1). From the peak value in Q3/2018 to Q3/2020, the decline amounts to -5.7% or -0.56 Euros/m² to currently 9.25 Euros/m². Since the same quarter of the previous year the relative decline has been -1.4%. In the same period, rents in the surrounding districts rose significantly by up to +8.7% in the district of Märkisch-Oderland, albeit starting from a much lower level. The city of Potsdam even recorded an increase of 11.2%. Here, a new rental agreement in Q3/2020 with an average of 10.15 Euros/m² in an existing apartment is now almost one Euro more expensive than in Berlin. Increased suburbanisation into the surrounding area of Berlin is increasingly driving up prices here. Within the administrative districts, there is also a widening gap between the surrounding area and the more distant municipalities. In the near future we will therefore take a closer look at the surrounding area and publish an analysis in our blog.

Our customers can obtain the current data of the empirica property price index from the market studio. The empirica regio housing market reports also contain the current quarterly data. Further information on the price index can also be found on the website of empirica ag.