empirica Housing Market Index

The empirica housing market index is an important tool for assessing the price development of supply data on the German property market. It provides a comprehensive overview of the price movements of residential property in various regions of Germany.

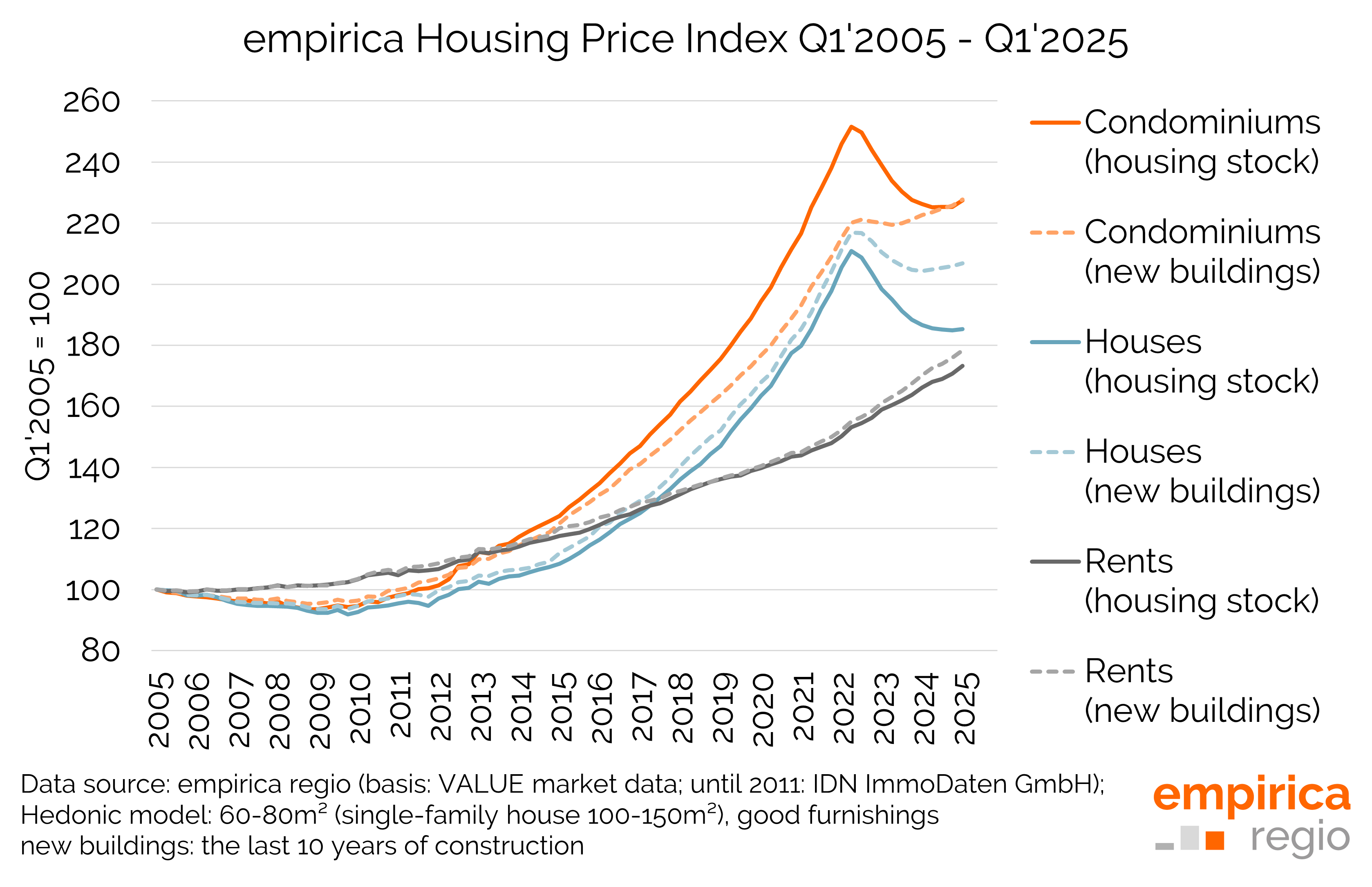

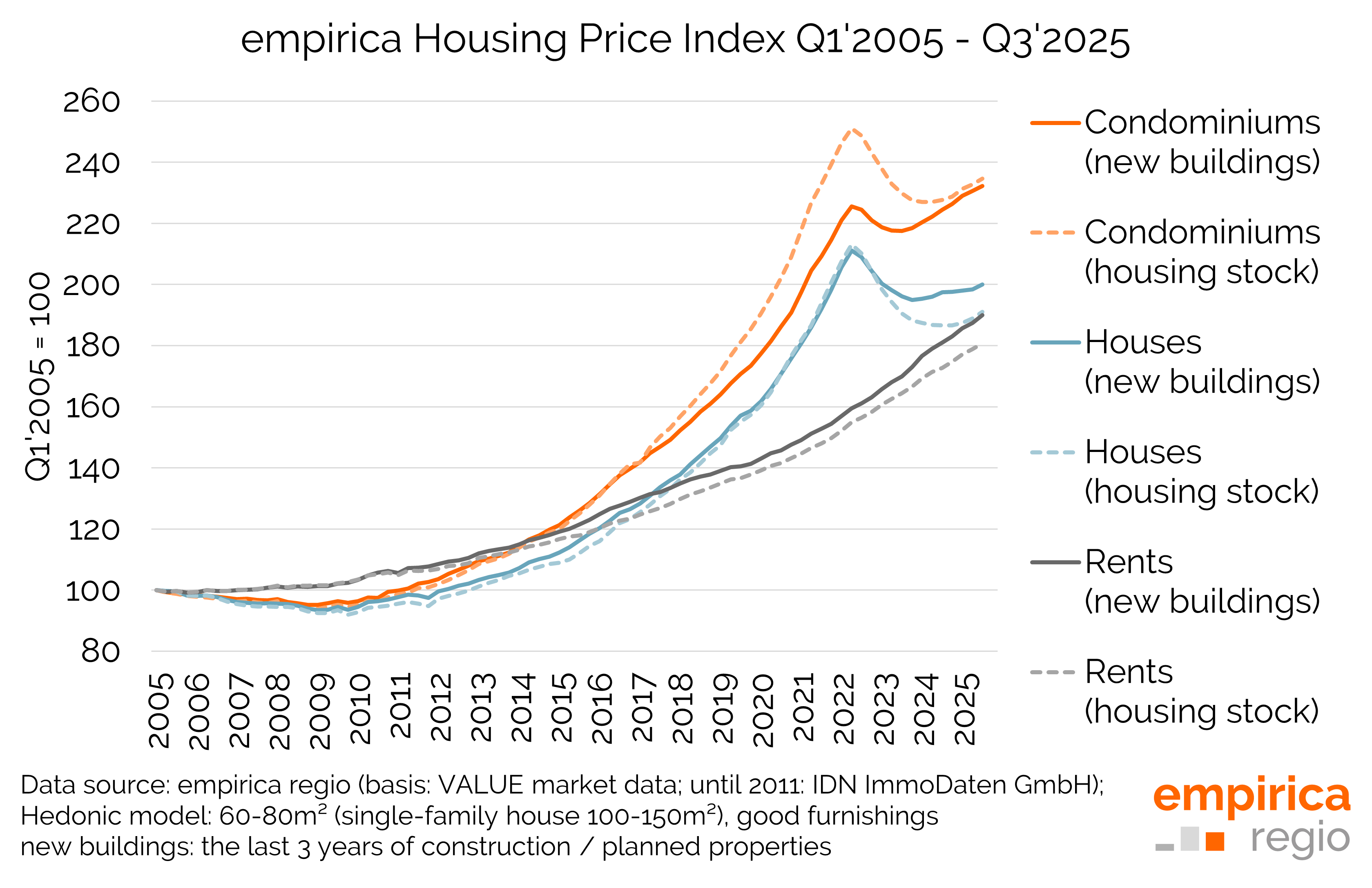

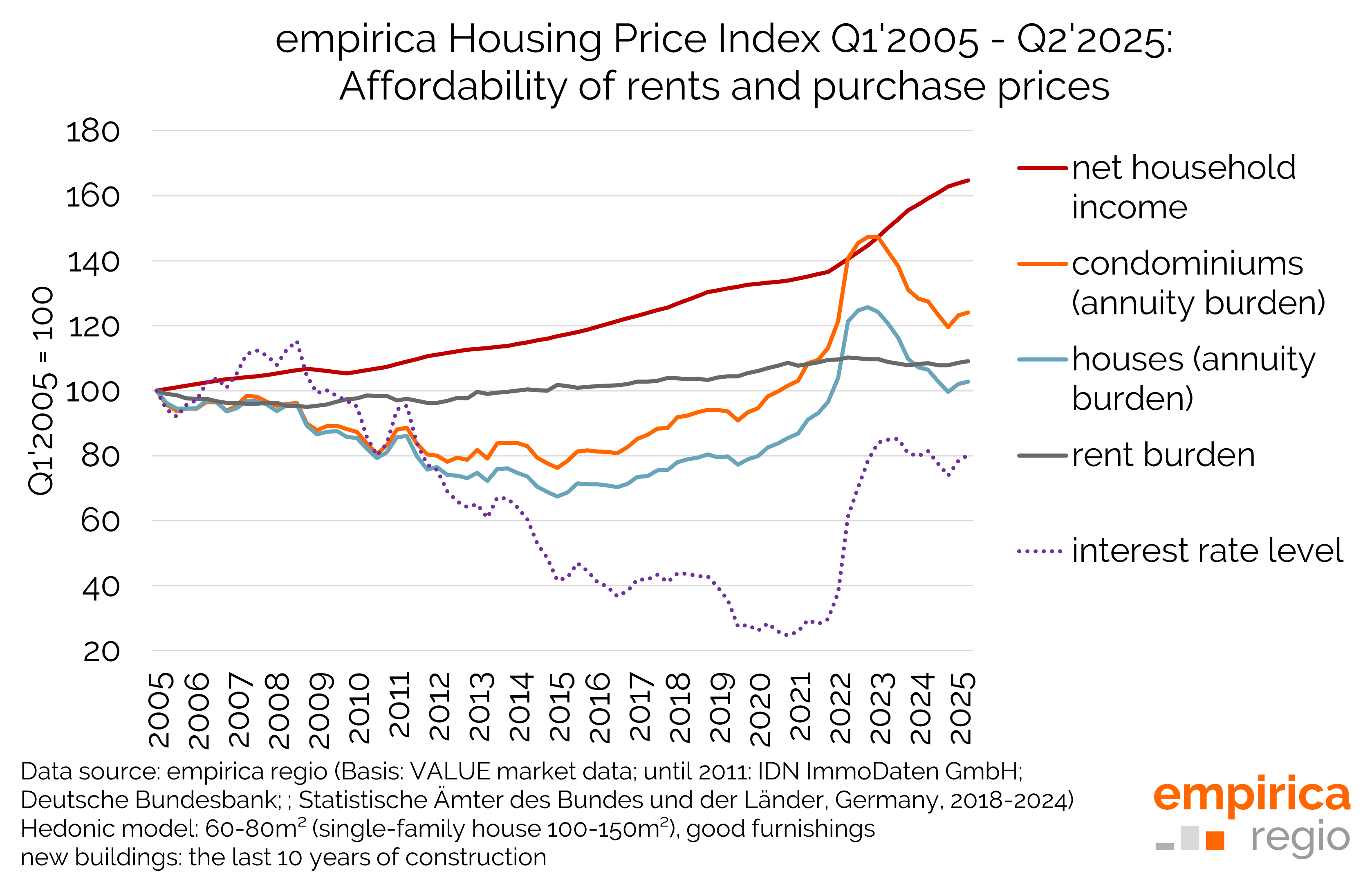

The empirica real estate price index up to and including Q4/2025 paints a mixed picture of the real estate market. Prices for new condominiums and single-family/two-family homes are not showing any short-term growth, but in the medium term, prices have recovered since the beginning of 2024. Prices for existing condominiums have also been recovering since the beginning of the year. Rents, on the other hand, are rising steadily, but show a slight slowdown compared to the previous year’s growth.

Purchase Options

Are you interested in the empirica Housing Market Index? You can obtain the data at district level from empirica regio as access to the empirica regional database (Market Studio and RESTful API ). In addition to access to the housing market index, you benefit from a wide range of other data. You also get immediate access to the updated index as soon as it is published.

If you are interested in a consultation appointment or an individual offer to obtain the empirica housing market index, please contact us by e-mail at info@empirica-regio.de or under +49 (0) 30 884 795 55.

Revision 2025

Due to the massive slump in building permits since 2022 and as a result of completions and advertised new construction supply, as well as the diverging price trends for new and existing properties, a fundamental revision of the empirica housing market index was carried out. The key change concerns the new-build index, which now only reflects prices for new flats built in the last three years and planned projects (instead of the last ten years). No values are shown for regions without sufficient new-build supply in this narrower age category. The existing property index has also been revised to take greater account of shifts in the supply mix (e.g. a higher proportion of older flats). The entire time series has been revised on the basis of the new methodology; the new values are no longer comparable with previous calculations and should only be used for temporal analyses.

Data Source and Methodology

The empirica price database for property prices dates back to 2004 and is by far the largest collection of property listings in Germany. Since 2012, we have based our analyses on the VALUE market database, which offers a random sample independent of the reference date with professional Doppler adjustment (cross-sectional and longitudinal) and expert-supported plausibility checks. The hedonics used here are based on a bottom-up approach that aggregates from 400 regressions at district level to regional, federal state and national values.

Advertised asking prices are shown in euros/m², for 60-80m² (single-family homes 100-150m²), good fittings, new build the three respective construction years and planned properties), existing buildings (all older construction years) and all construction yearsn. The prices are adjusted using a hedonic procedure. This is necessary because the number of advertised flats can vary from quarter to quarter. The determination of hedonic prices is a procedure that takes into account changes in quality (furnishings, flat size, age of construction, etc.).

Detailed results and further information on the methodology can be downloaded here: