Commuter flows - the surrounding area of the metropolitan areas is becoming more and more important

The surrounding areas of Germany’s A-cities are becoming increasingly important as places to work, this is the result of an analysis by empirica regio GmbH. We have examined the commuter balances, commuter rates and commuter links of the German metropolises and their surrounding areas.

Munich and Berlin record the highest growth in commuters

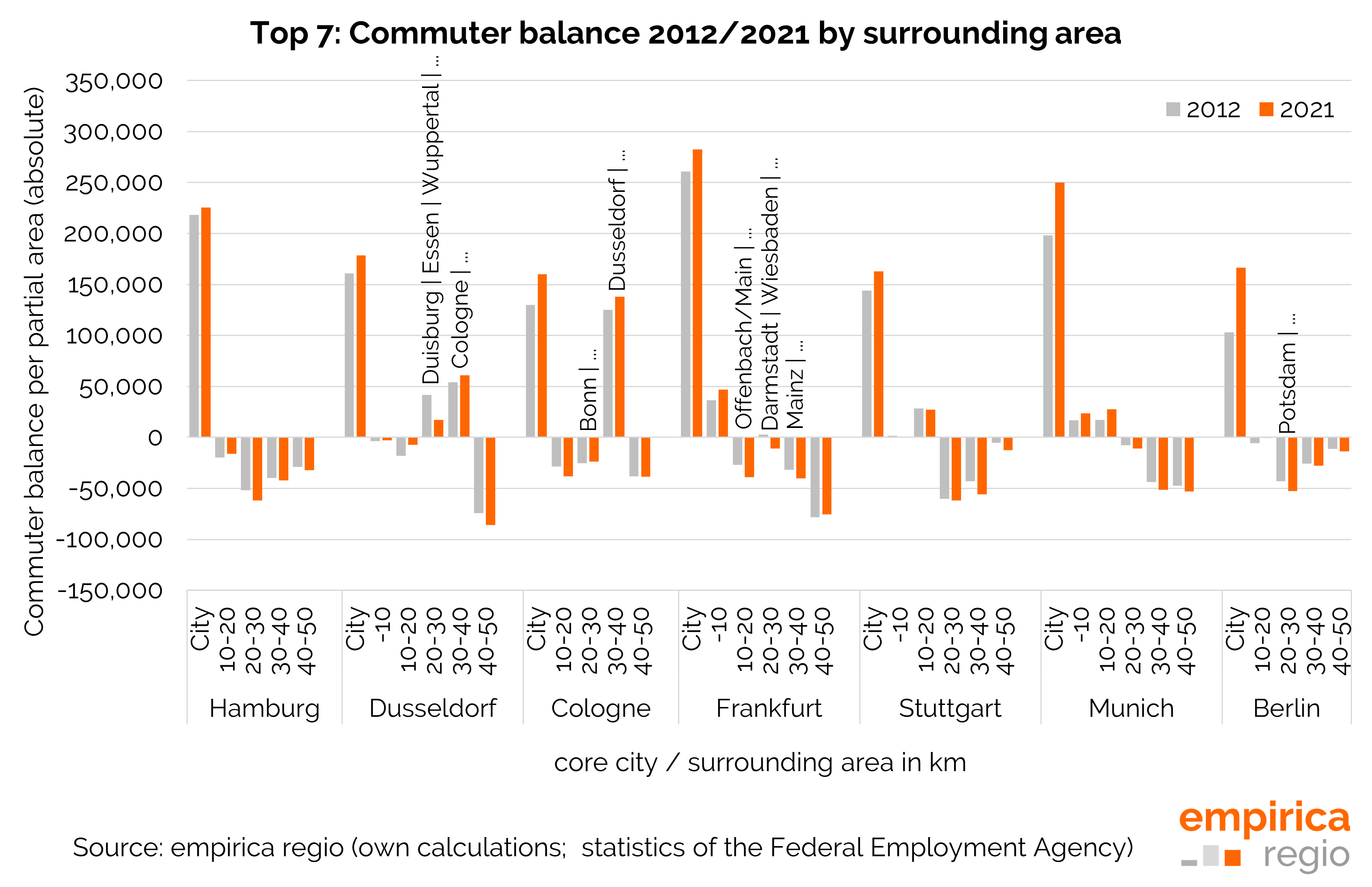

As a result, Munich recorded the largest increase in the number of commuters from 2019 to 2021 with growth of 6.77 per cent, followed by Berlin with 5.17 per cent, Cologne with 2.13 per cent, Düsseldorf and Stuttgart with 1.53 and 1.14 per cent respectively, and Frankfurt am Main bringing up the rear with a manageable growth in commuters of 0.36 per cent.

Jan Grade, CEO of empirica regio: “The German metropolitan areas continue to attract a growing number of non-local workers. This will not change in the future. However, a look at job centrality shows that the surrounding areas are also becoming increasingly important as a place to work.”

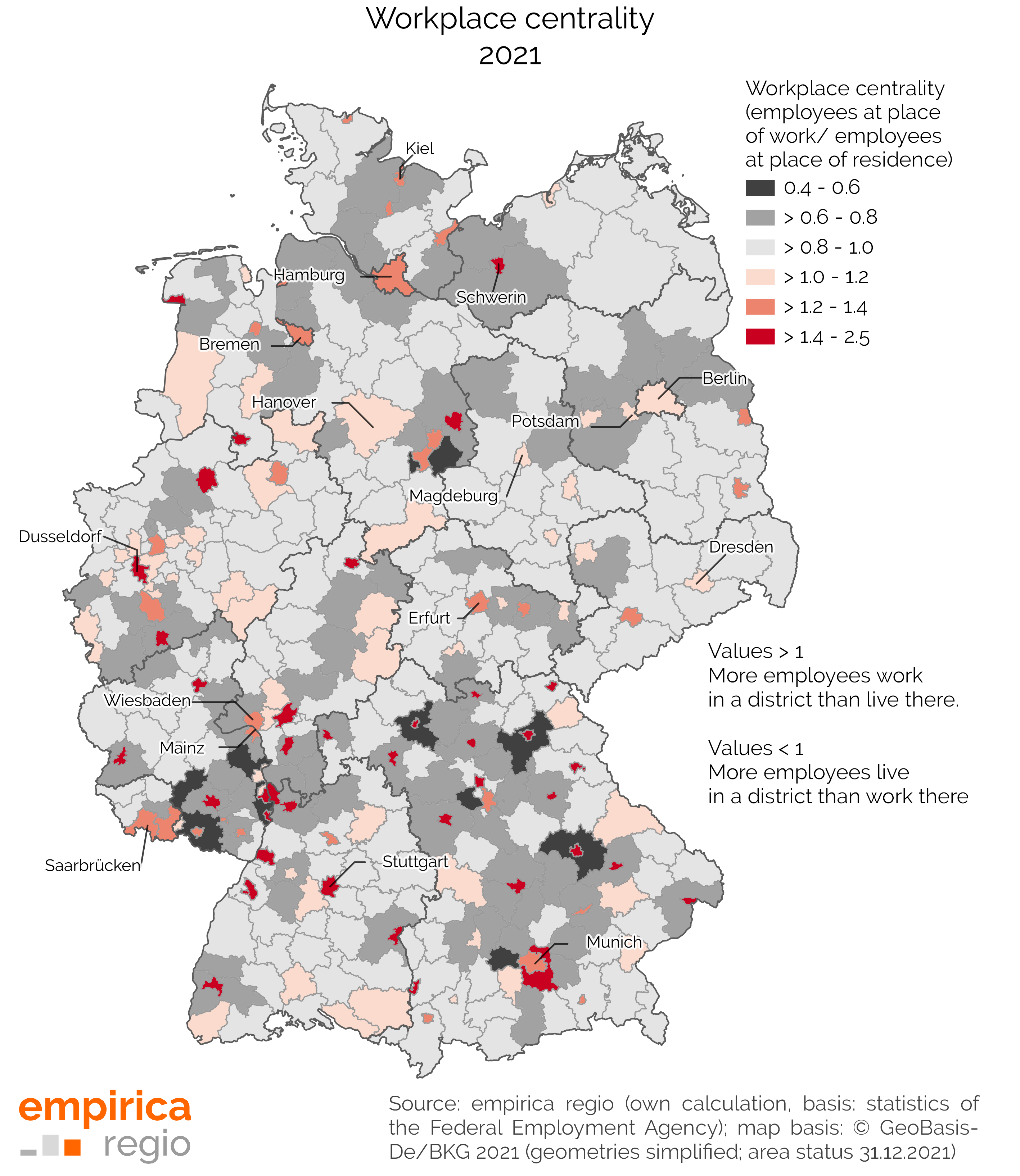

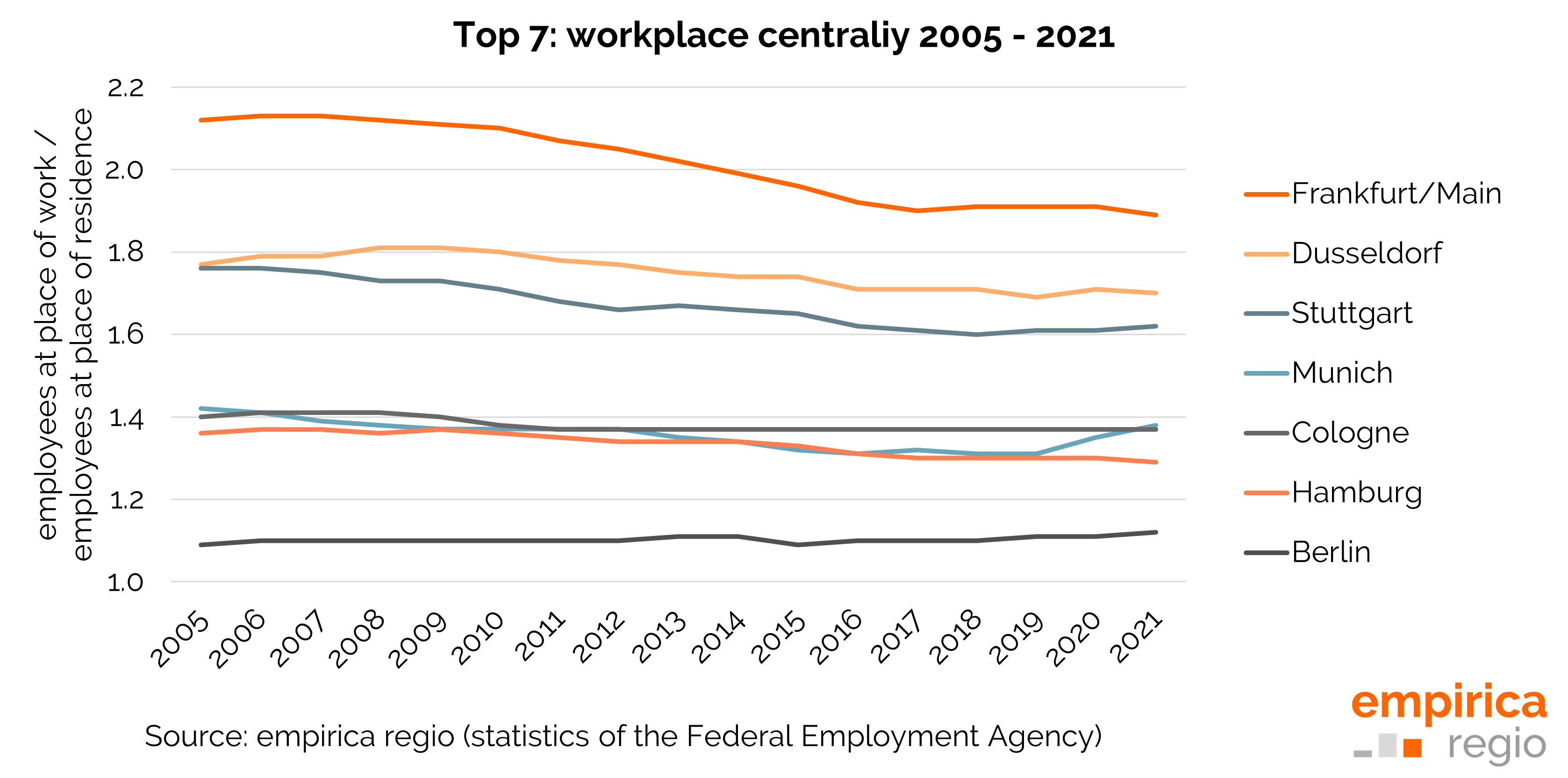

Workplace centrality stagnates

The centrality of workplaces is largely stagnating in all German major cities. Job centrality describes the importance of a location as a place of work. In practice, the number of employees living there is put in relation to the number of employees working there. If the number of employees living in a city increases faster than the number of jobs in a city, then the centrality decreases.

Since immigration to the major cities, especially by young adults and young professionals, was for a long time significantly higher than emigration to the surrounding areas, the increase in the resident population caused a decline in centrality. At the same time, the proportion of commuters from the major cities is steadily increasing: In Frankfurt am Main, Düsseldorf and Stuttgart, more than a third of the employees living there now work outside the city limits.

In all of the top 7 cities, more people work than live there. However, for years we have seen stagnation and in some cases even slight declines, despite growing commuter numbers. The explanation is multi-layered: on the one hand, we have seen significant population growth in the core cities, and on the other hand, more city dwellers work in the surrounding areas. So the cities continue to be strongly intertwined with the surrounding areas, but the surrounding areas are gaining in importance as places to work and, due to scarce housing and high prices, as places to live.

Frankfurt/Main: Germany’s commuter capital

The strongest core city interdependence between place of work and place of residence can be observed in Frankfurt with a value of 53.8. Dusseldorf has the second highest interdependence rate (52.9), closely followed by Stuttgart (52.1). This is followed by Cologne (42) and Munich (39.7) as well as Hamburg (28.4). The lowest interdependence rate can be observed in Berlin (18.7). The commuting ratio describes the ratio of commuter volume (commuters in and out) to commuter potential (employees at the place of residence and at the place of work). The value can be between 0 (no integration) and 100 (complete integration). The basic principle for the entire country is: the larger the urban area, the fewer commuter movements into the surrounding area.

Positive commuter balances are not only found in the core cities themselves. The cities and municipalities in the immediate vicinity of Frankfurt am Main, Stuttgart and Munich also have positive commuter balances. The direct hinterland is made up of municipalities up to ten kilometres away from the centre, in the case of Munich even 20 kilometres as the crow flies. With Eschborn near Frankfurt and Garching near Munich, two labour market centres have even formed at the gates of the metropolises, to which more people commute than actually live there.

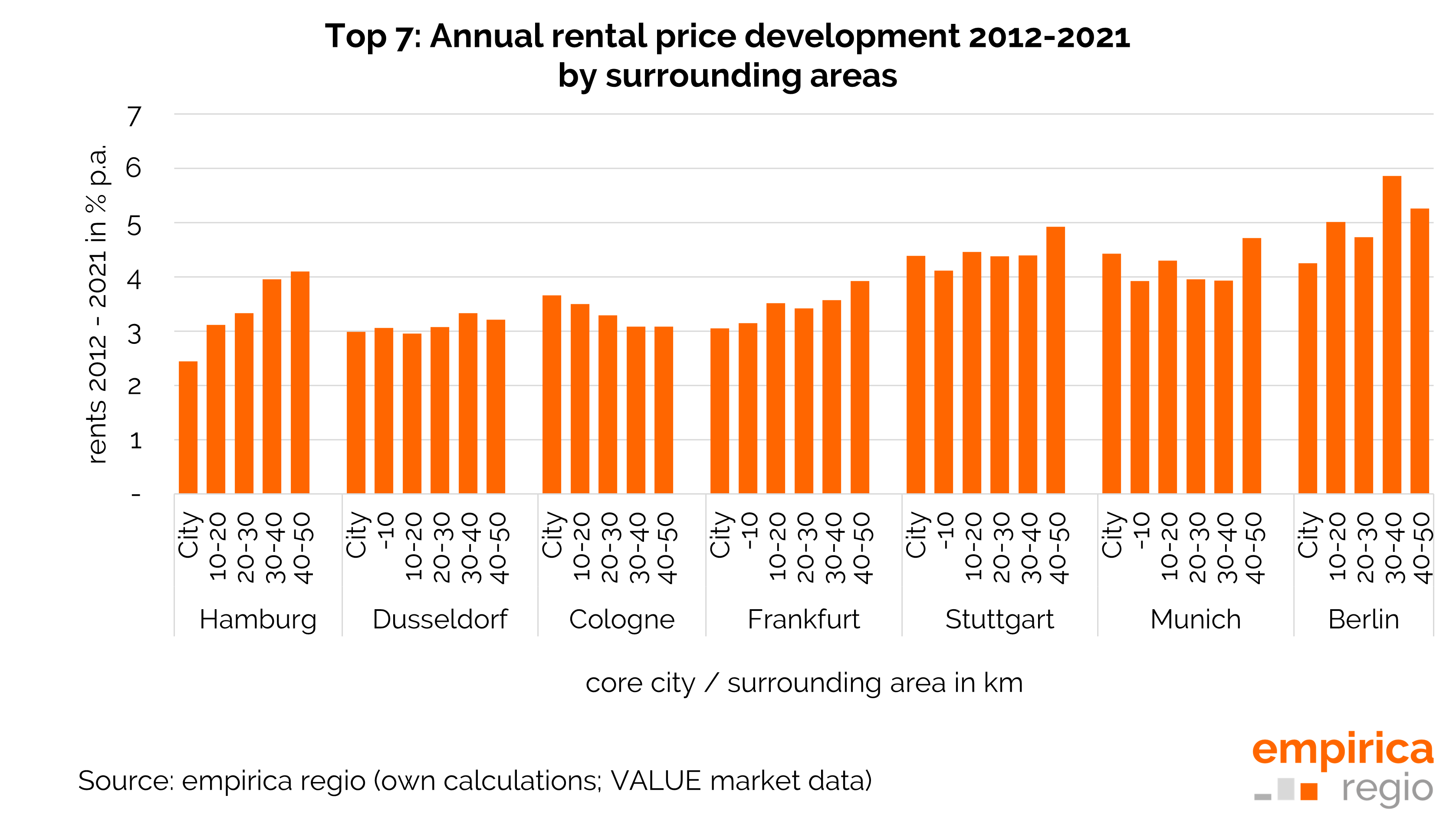

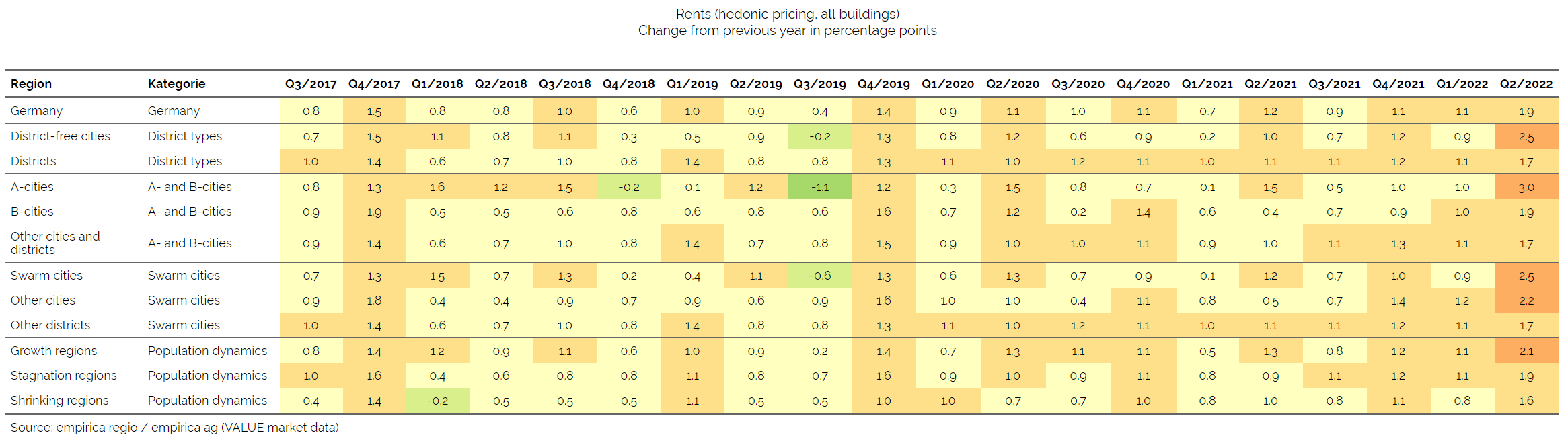

The increasing importance of the surrounding areas is reflected in the rapid rise in rent levels - rents are catching up with the core cities. Many employers and employees are nevertheless moving to the still cheaper surrounding areas.

In order to counteract the loss of importance of the core cities as places to live, the cities would have to keep young families in the city in particular. This would also help to avoid increasing urban sprawl and achieve greater stability in the housing market. This requires above all housing programmes for young families and new construction that takes the needs of this target group into account.

The question of where companies locate depends not only on the availability of land but also on how well a location is connected to regional and supra-regional transport links. However, the question of whether employees can find affordable housing in the region also plays an increasing role, as shown, for example, by the increased interest in the topic of employee and company housing. Affordable company housing is again increasingly being arranged by employers for their employees, often through the real estate subsidiaries of the companies.

Our new-build demand forecast shows a high demand for detached and semi-detached houses, especially in the surrounding areas of the metropolises, but it also only follows the trends of the past years. However, these trends result in particular from the high migration rate of families from the core cities and thus the migration of a population group with purchasing power and willingness to buy to the surrounding areas. This development threatens to push the already often overburdened transport infrastructure to its limits. Many families would have liked to stay in the cities if there had been an adequate supply of housing.

Real estate investors and developers should include commuter structures in their investment decisions in order to make the labour market centres and residential locations of a region visible. Trends in employment figures show where new job centres are forming, and good public transport connections between these centres are crucial in order to survive as a place to live and work in an increasingly interconnected region.