empirica Housing Market Bubble

The empirica Housing Market Bubble Index provides a relative risk assessment of the regional housing markets. It is based on the analysis of increases in various indicators and not on the exceeding of absolute threshold values due to the specific local characteristics.

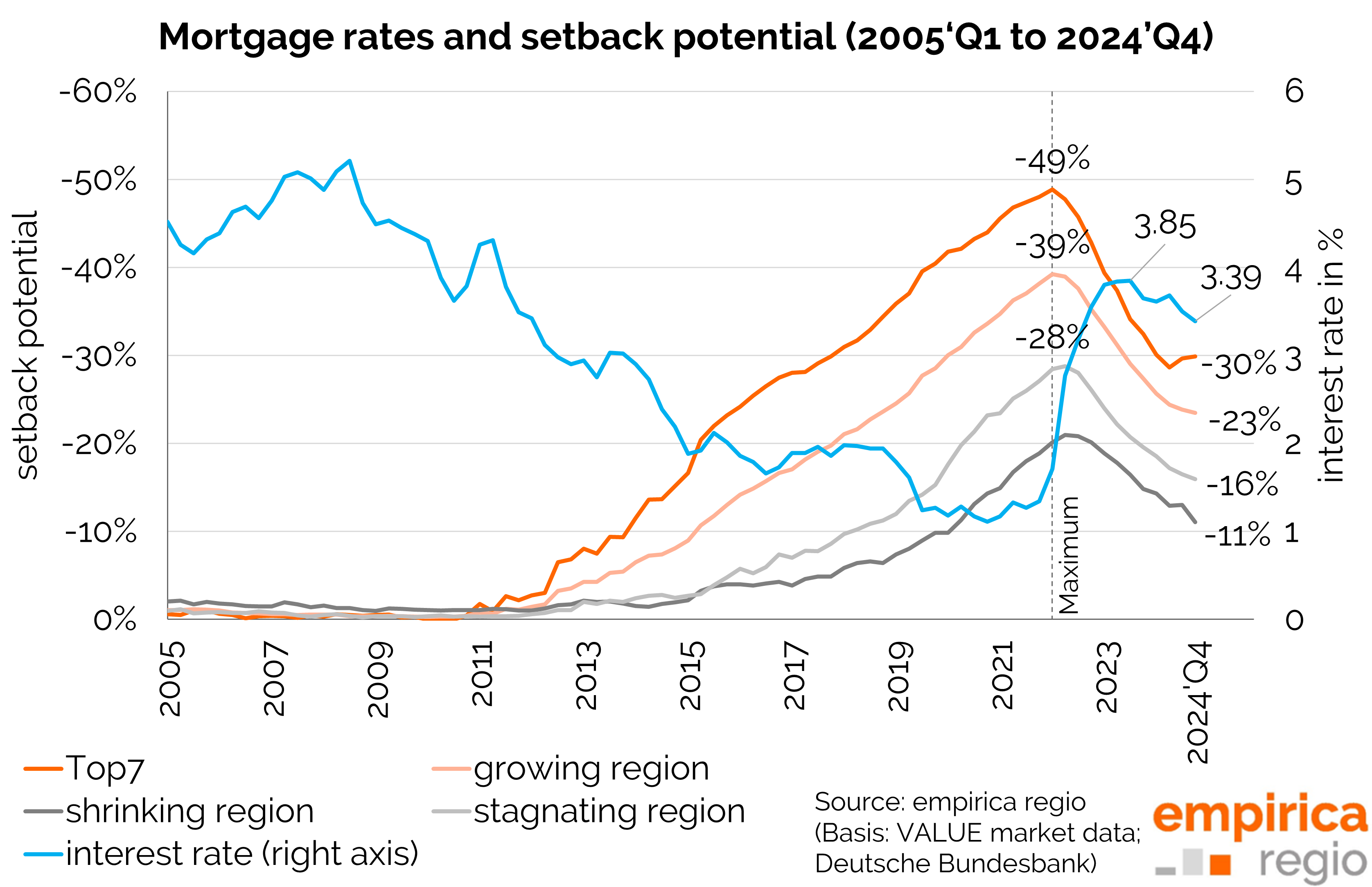

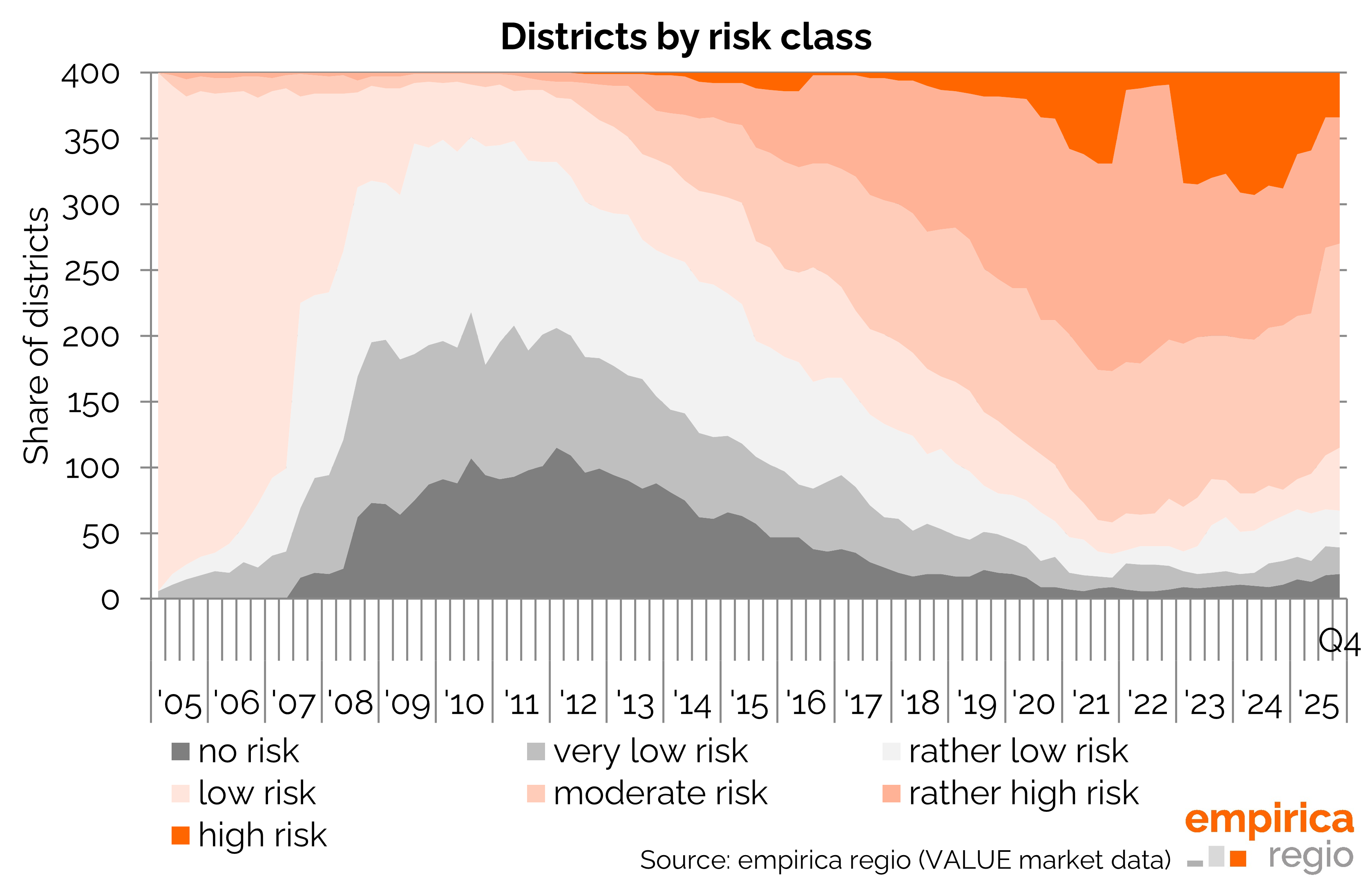

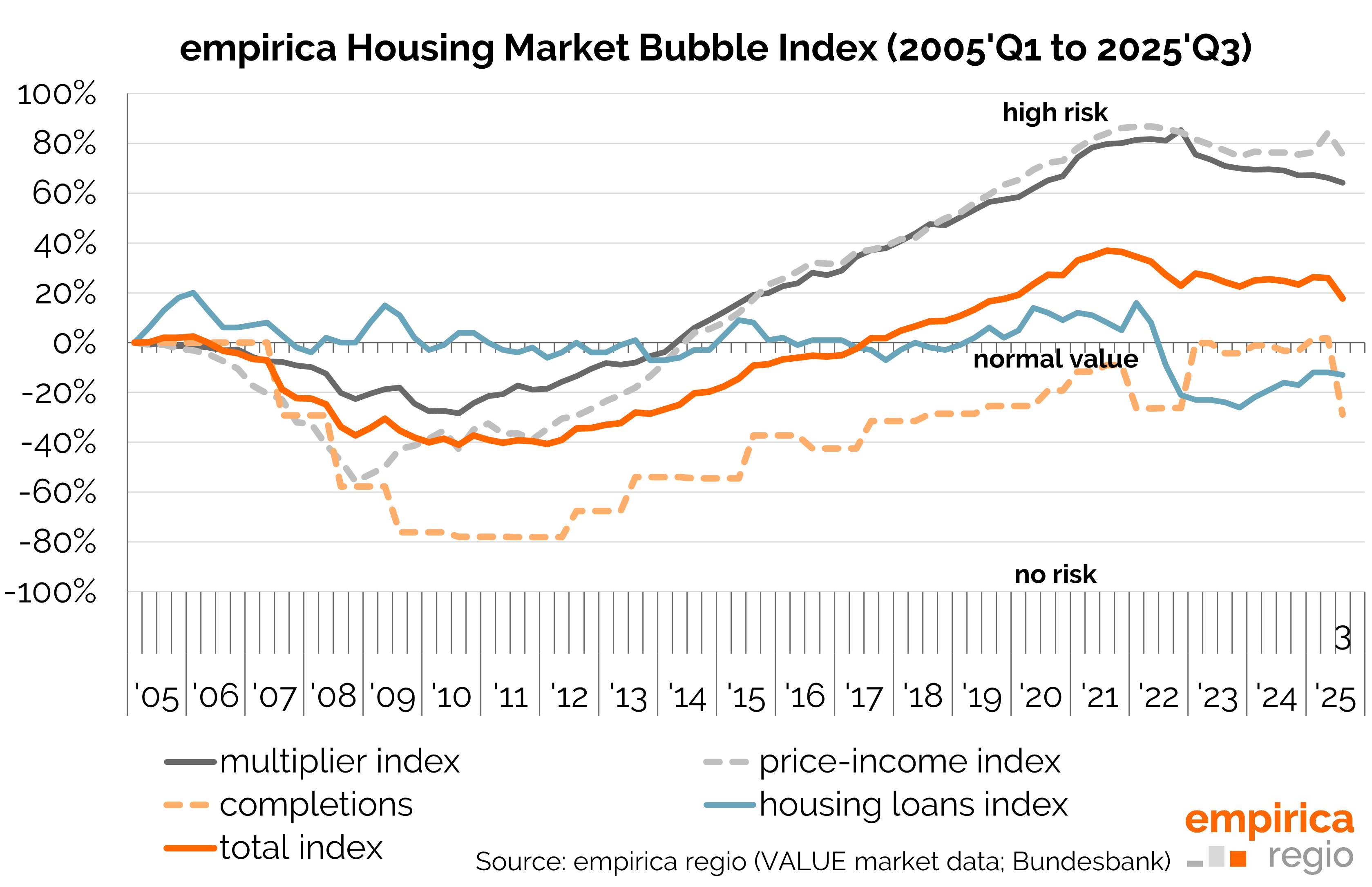

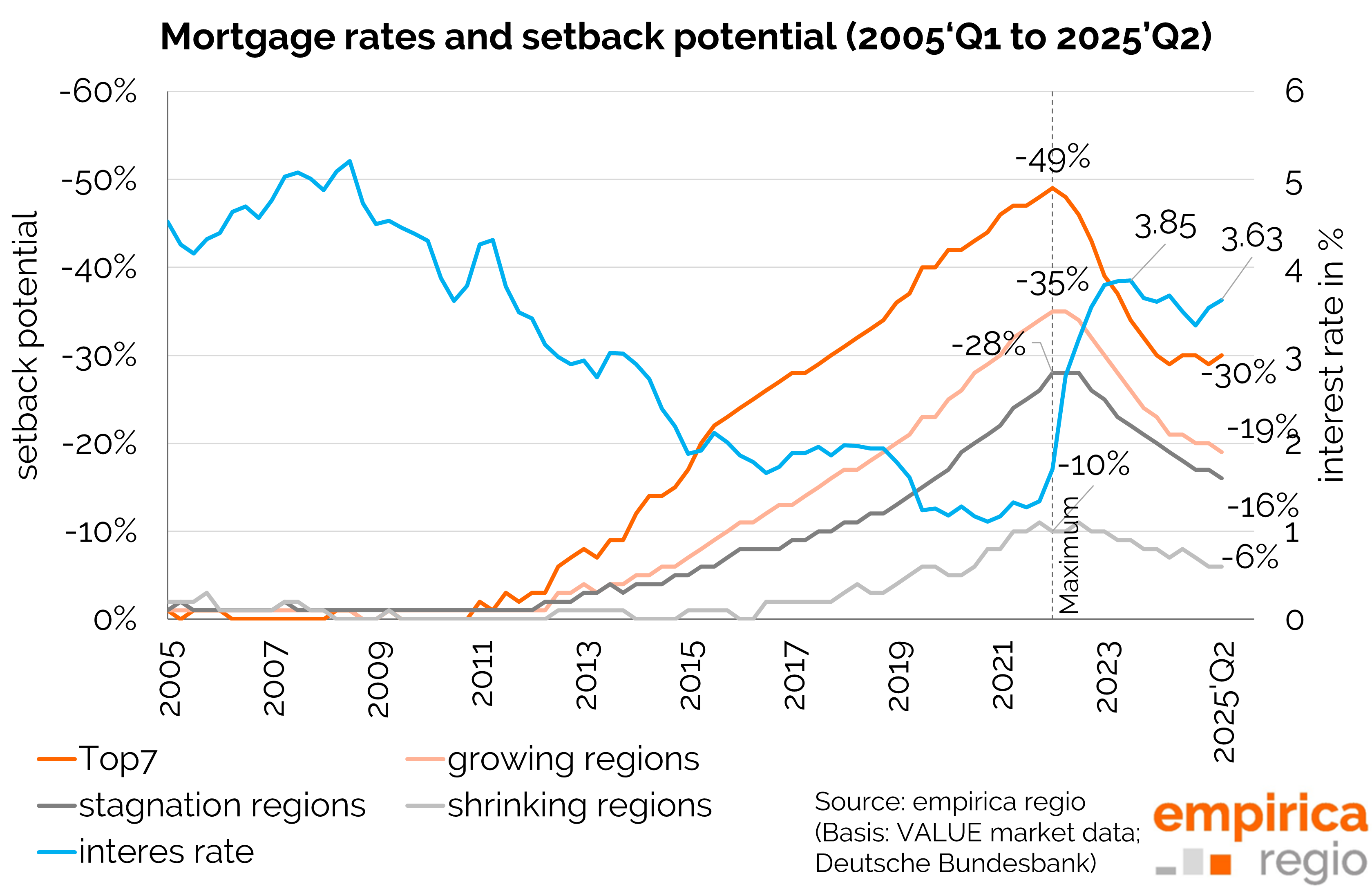

The risk of a bubble is declining slightly, as rents are currently rising faster than purchase prices. This means that potential price setbacks are shrinking, albeit more slowly than immediately after the interest rate turnaround. The sub-index for price-income is falling particularly sharply. The prevalence is thus declining, and the number of threatened areas is decreasing.

Purchase Options

Are you interested in the empirica Housing Market Bubble Index? You can obtain the data at district level from empirica regio as access to the empirica regional database (Market Studio and RESTful API ). In addition to access to the housing market bubble index, you benefit from a wide range of other data. You also get immediate access to the updated index as soon as it is published.

If you are interested in a consultation appointment or an individual offer to obtain the empirica housing market bubble index, please contact us by e-mail at info@empirica-regio.de or under +49 (0) 30 884 795 55.

Revision 2025

For Q3 2025, we have conducted a fundamental revision of the empirica housing market index , which also has an impact on the bubble index. In particular, this changes the multiplier and price-income sub-indices of the empirica bubble index. The new values are no longer comparable with the previous calculations. Therefore, the entire time series from 2005 onwards has been revised. Only these revised data should be used for temporal analyses.

Methodology

A bubble is a speculative price increase that can no longer be justified by the fundamental relationship between supply and demand. However, it is not so much the high prices themselves that are harmful, but rather the resulting exaggerated scarcity. This leads to misallocations: housing construction and the lending required for it are boosted excessively, and capital for alternative investments becomes scarce. However, a bubble only becomes dangerous when it bursts. Assets are then destroyed because the book values of the properties lose value. Vacancies arise and, in the worst case, a banking crisis occurs because loan defaults get out of hand.

The bubble index can only indicate the threat of a bubble forming and display various warning levels. For the calculation, the three individual indicators - multiplier, price income and construction activity - are monitored on a quarterly basis. The (regional) risk of a property bubble increases if the corresponding comparative values from 2005 or the demand forecast are significantly exceeded. The year 2005 represents a normal phase in which nobody suspected a price bubble and the market was slightly undervalued.

Detailed results and further information on the methodology can be downloaded here: