Housing bubble index Q4/2025: Rent increases and slump in new construction slow down bubble risk

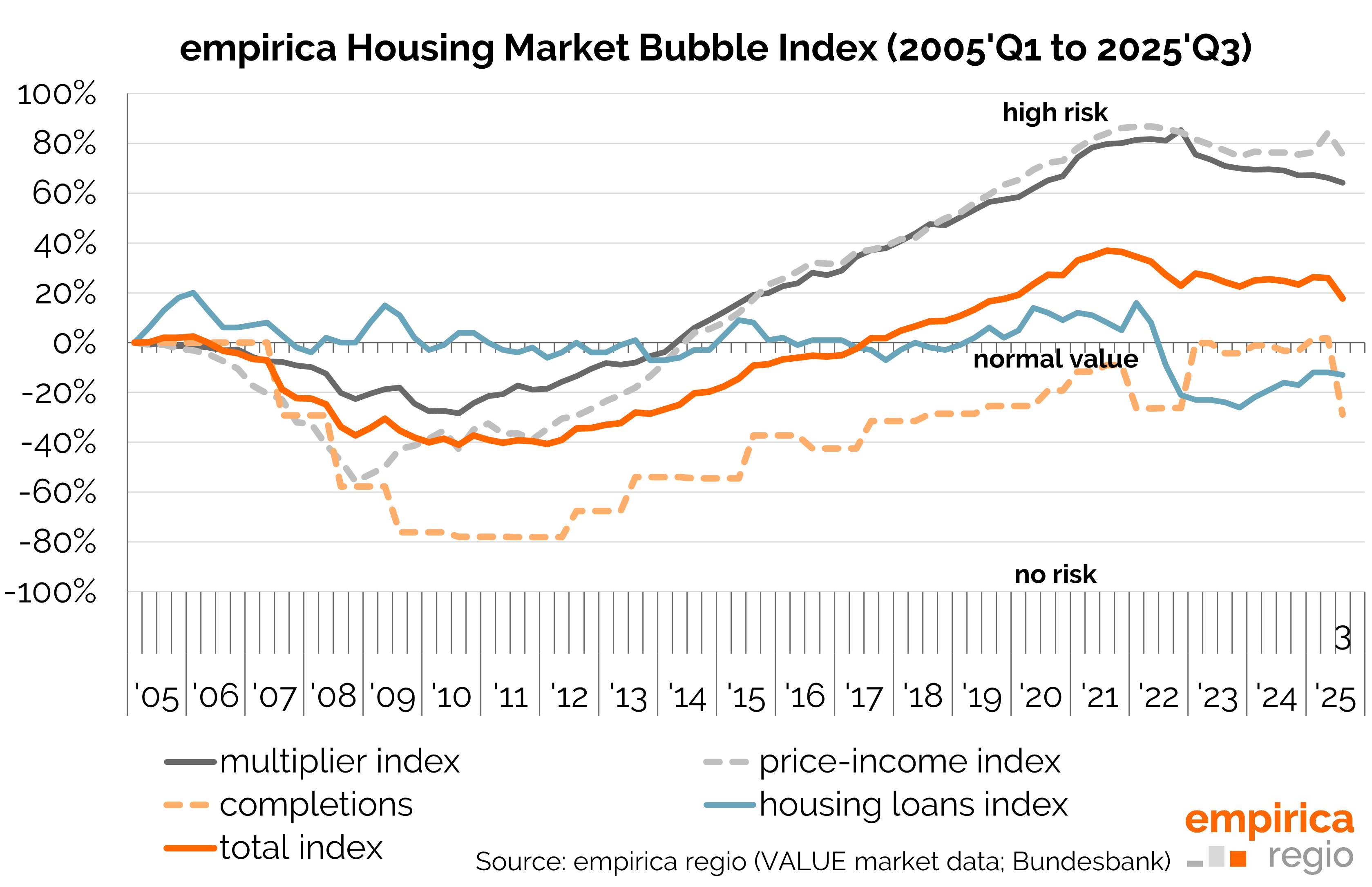

Rising rents and a slump in new construction are slowing down the risk of a bubble, but housing prices are still not completely out of the woods. All sub-indices are declining. The sub-index for price-income (-2 points) shows the sharpest decline. In contrast to the last quarter, however, there are only moderate changes across all indices. The overall index declines marginally (-1 point).

When rents rise, this is bad news for those looking for accommodation, but good news in terms of the risk of a bubble. This is because rising rents form a safety net for purchase prices: the value of a property is determined by the present value of future rental income. The higher the rental income, the greater the value, and the higher the interest rate, the lower the (present) value. Purchase prices have been rising faster than rents for a long time because interest rates have fallen. As a result, property prices have moved away from a sustainable valuation (because interest rates were not sustainably low). Conversely, the stronger the sustainable rise in rents, the lower the risk of bubbles bursting.

Incidentally, rising rents also mean that buying your own home is becoming more attractive again. This is because the higher the rent (as an alternative to mortgage payments), the less significant high mortgage payments for interest and repayment become. Rents are rising not only due to increasing demand or hoarding, but also due to slower growth in market supply: new construction activity has fallen from 3.4 dwellings per thousand inhabitants in 2023 to only 2.9 dwellings per thousand inhabitants in 2024. New construction will continue to decline in 2025, and no improvement is expected in 2026. Although the number of permits is currently rising, completions always lag behind – by 2-3 years in the case of multi-storey apartments, with only owner-occupied homes usually taking less time.

Developments to date

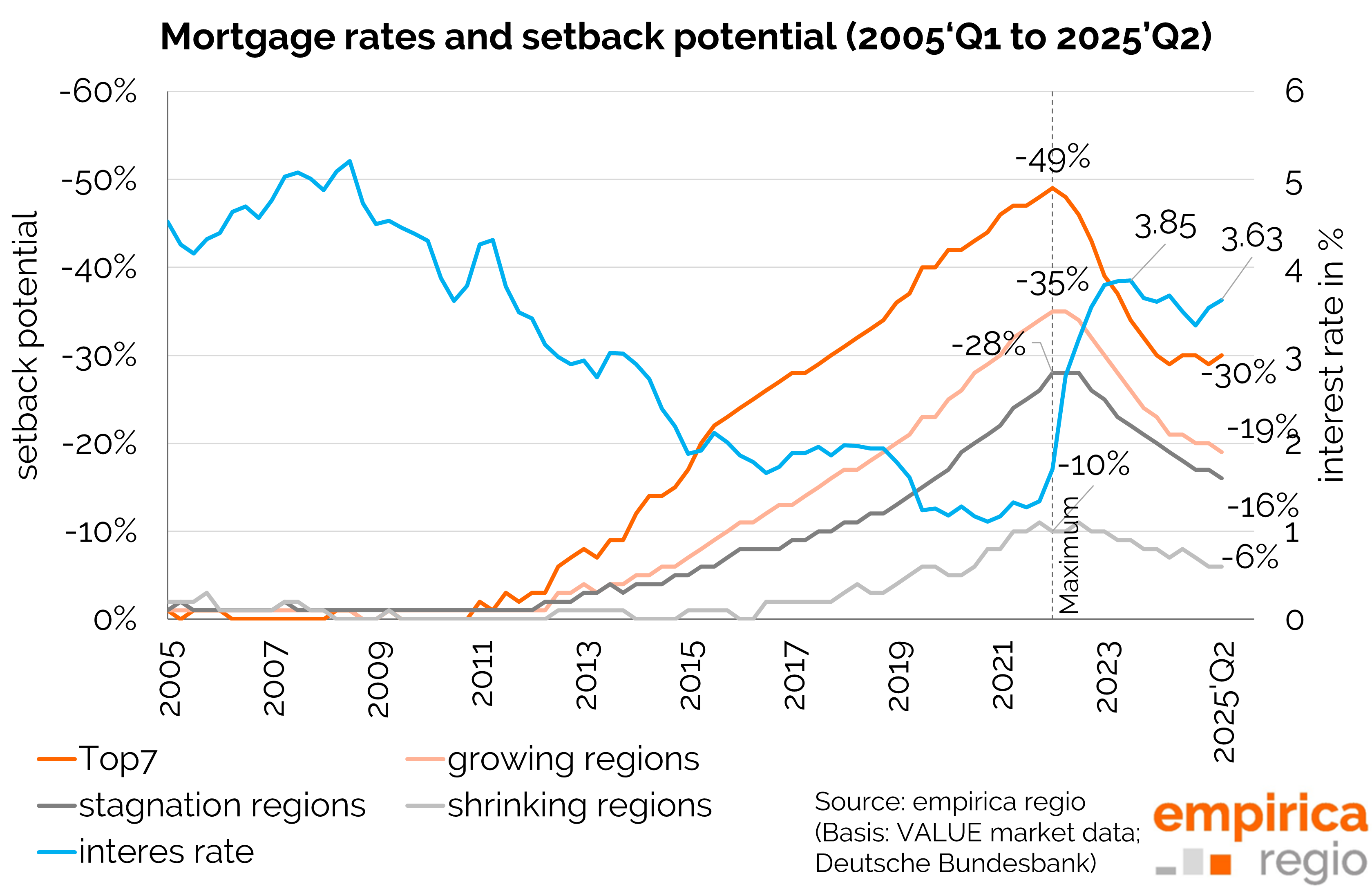

The situation remained very tense until 2022. Purchase prices had risen far above rents, buoyed by years of low interest rates (in new builds since Q3 2015: +84% for freehold flat prices compared with only +56% for rents). A bursting bubble seemed imminent. The rise in interest rates then brought about a turnaround: pressure on prices to fall grew. However, there has been no real decline in prices so far. The reason? Due to scarcity, rents are rising noticeably, thus stabilising price levels.

Future development

The current trend reflects the expectation that housing will remain scarce, primarily because new construction has collapsed (see sub-indicator ‘Completions’). However, it is uncertain whether this scarcity will persist in the long term. Demographic trends and fluctuations in the housing stock will be decisive factors. The risk of a bubble would increase if fluctuations increased (e.g. due to rent deregulation), as this would reduce the amount of ‘housing hoarding’, thereby increasing the supply available on the market and resulting in a sustained fall in rents for new contracts. The risk of a bubble would also increase if there were no new waves of immigration from abroad and/or structural unemployment rose permanently, as market demand would then no longer increase sustainably. This could put pressure on relative prices, especially in less sought-after properties and less attractive locations, both regionally (macro locations) and in city centres (micro locations).

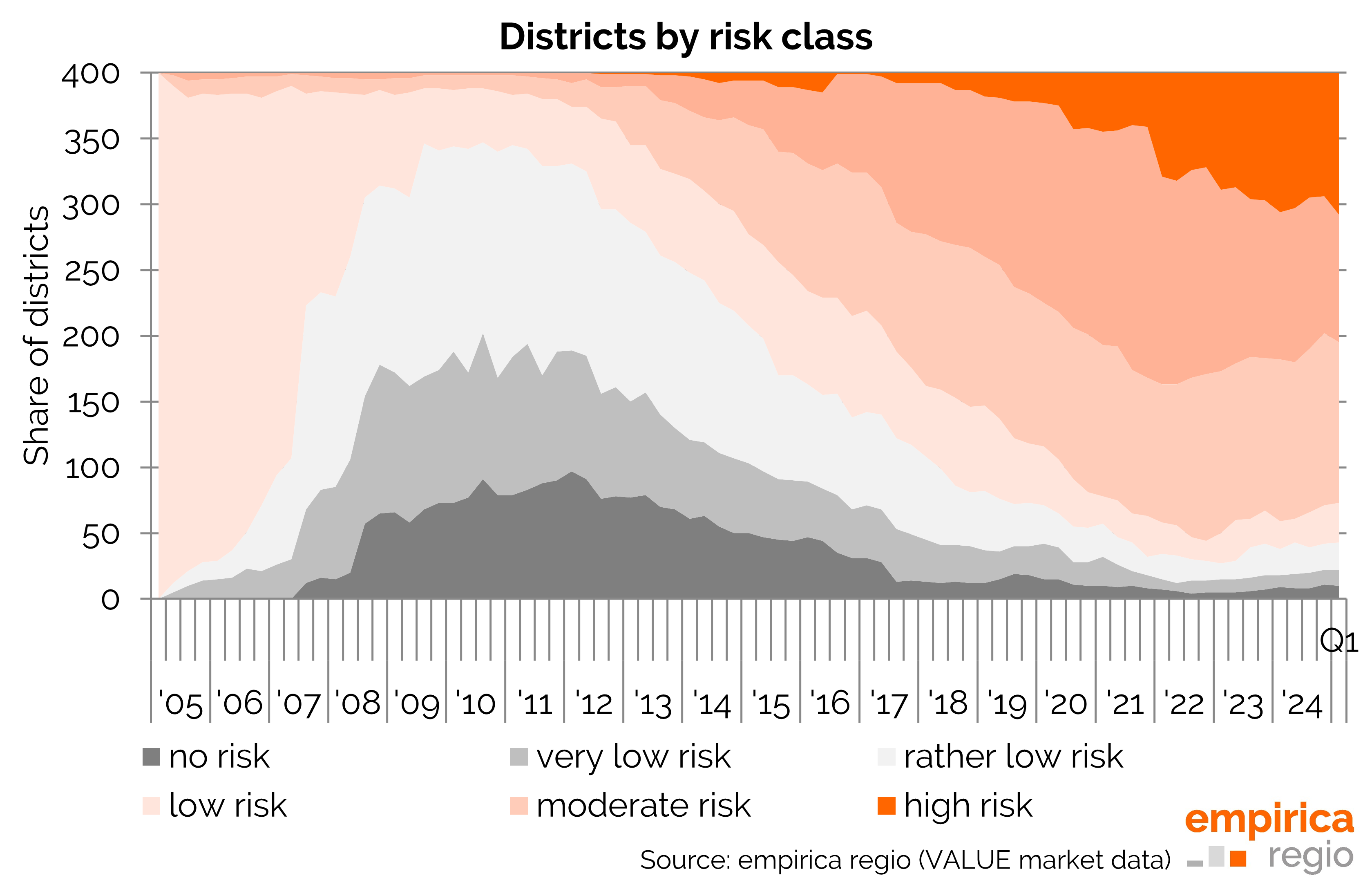

Regional distribution

In contrast to previous quarters, there has been little change in the distribution of districts across risk categories. The proportion of districts with a “high” or “rather high” risk therefore remains stable. In the group of the ten largest cities, Essen, Cologne and Dortmund currently have a “moderate” risk. There is a “high” risk in Hamburg, while the risk in all other cities is “rather high”.

Data basis empirica housing market bubble index

The empirica housing market bubble index is a quarterly index that assesses the risk of a property bubble in various regions of Germany. All data can be obtained as an individual dataset or via database access from empirica regio. Detailed results and further information on the methodology can be downloaded here: