Housing bubble index Q3/2025: Risk of a housing market bubble decreases

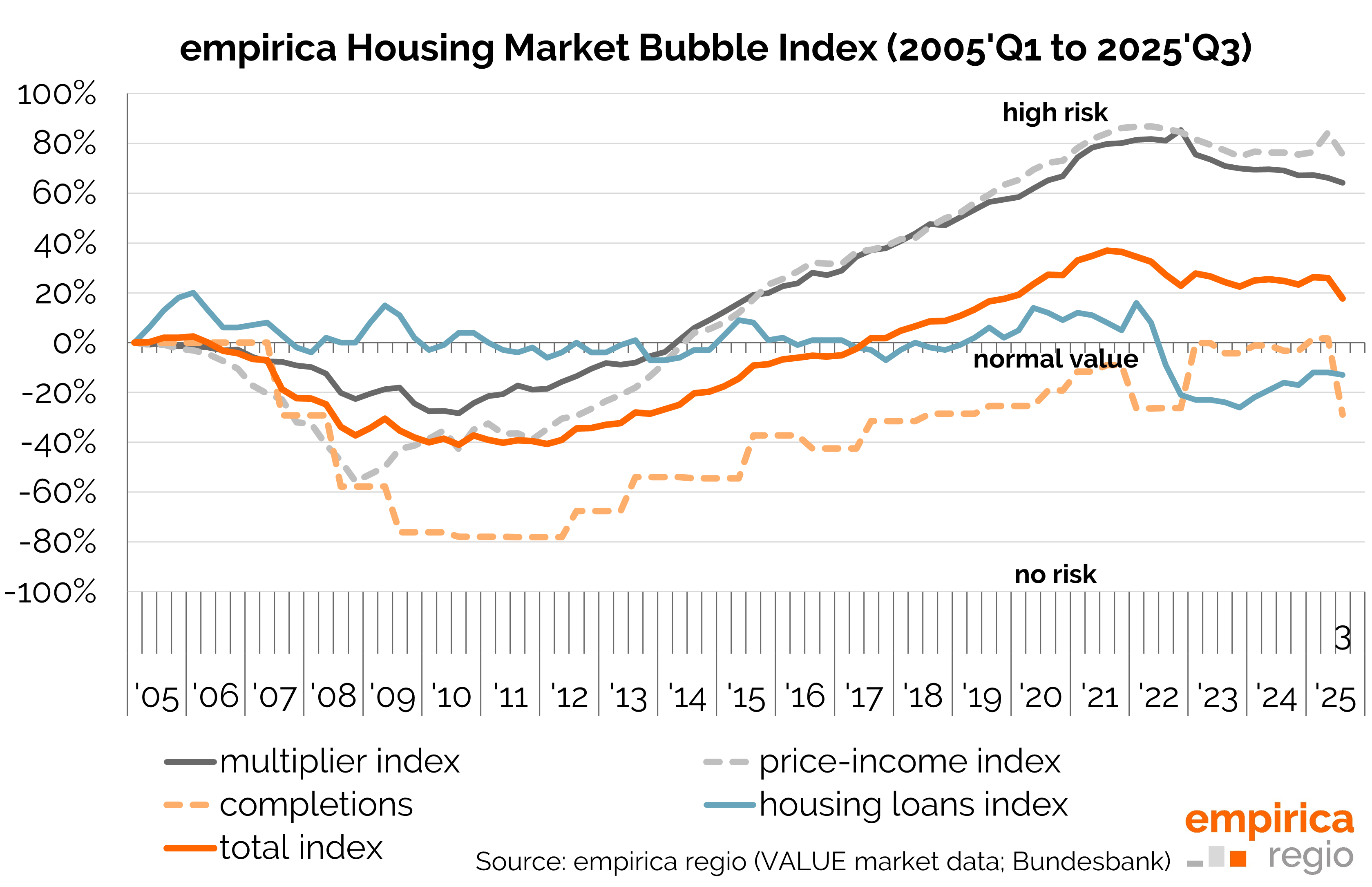

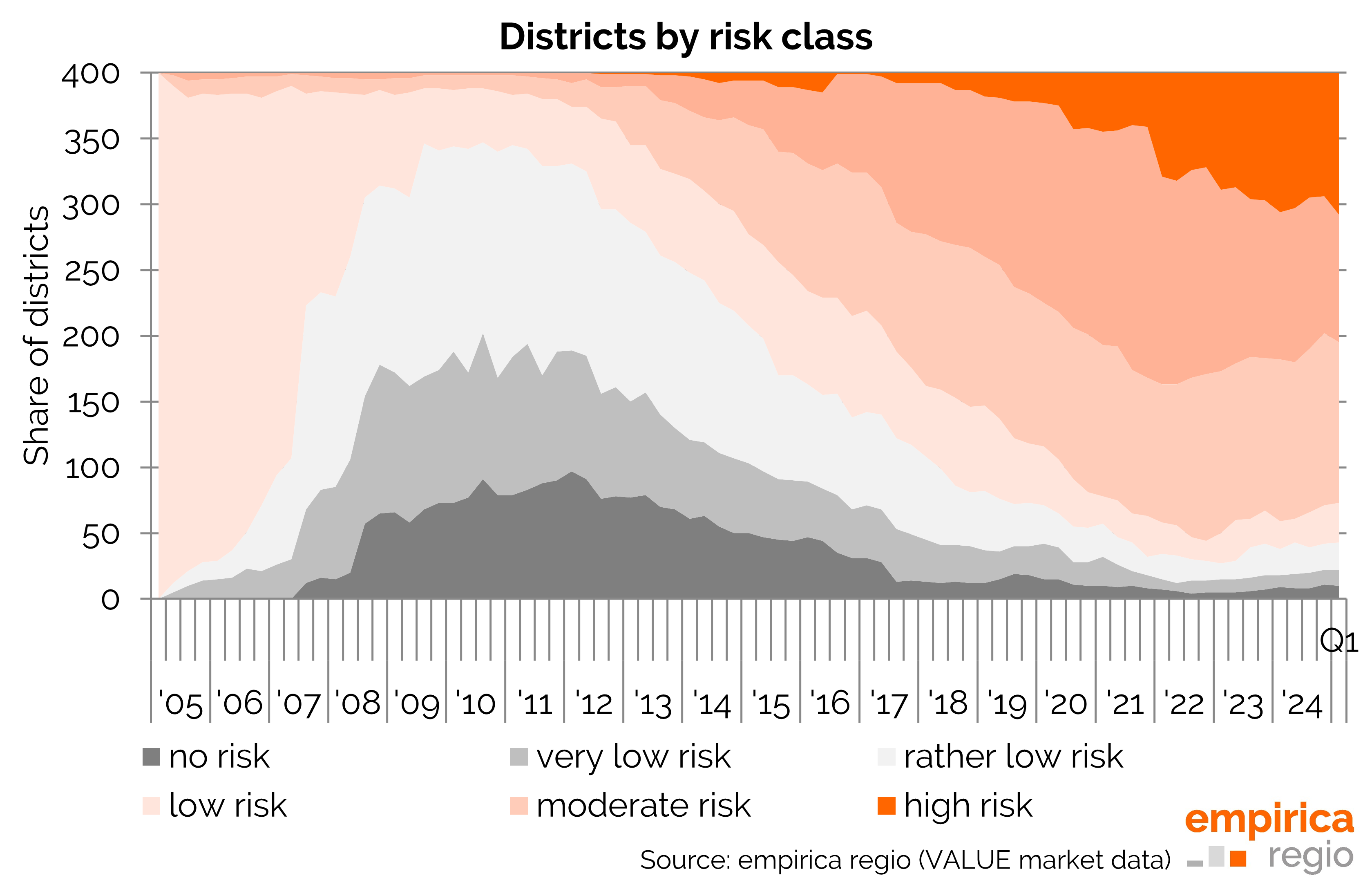

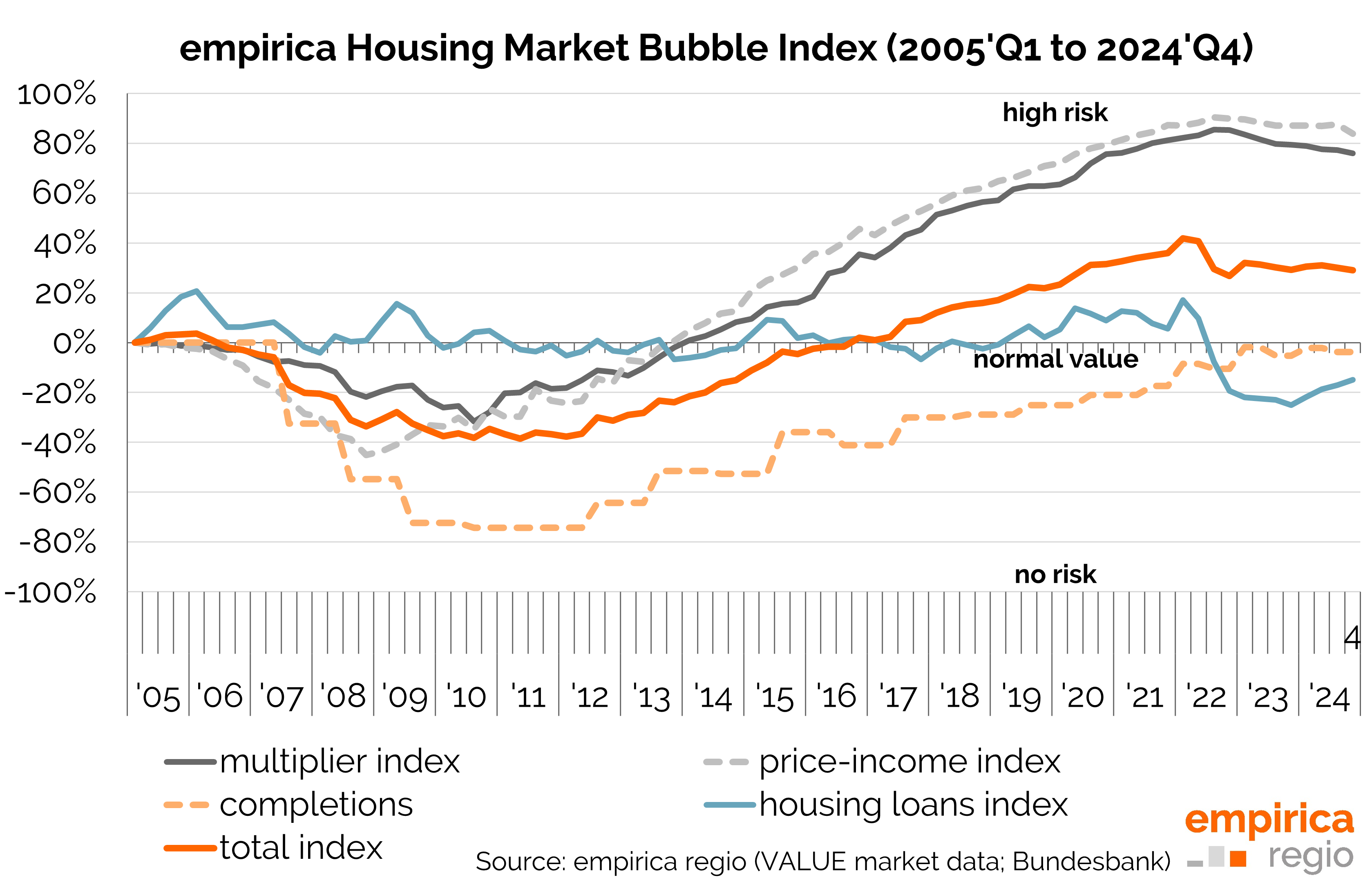

All sub-indices, with the exception of the construction loans sub-index (+1 point), are down. The completions sub-index (-30 points) has fallen particularly sharply. As a result, the overall index is down across Germany (-8 points).

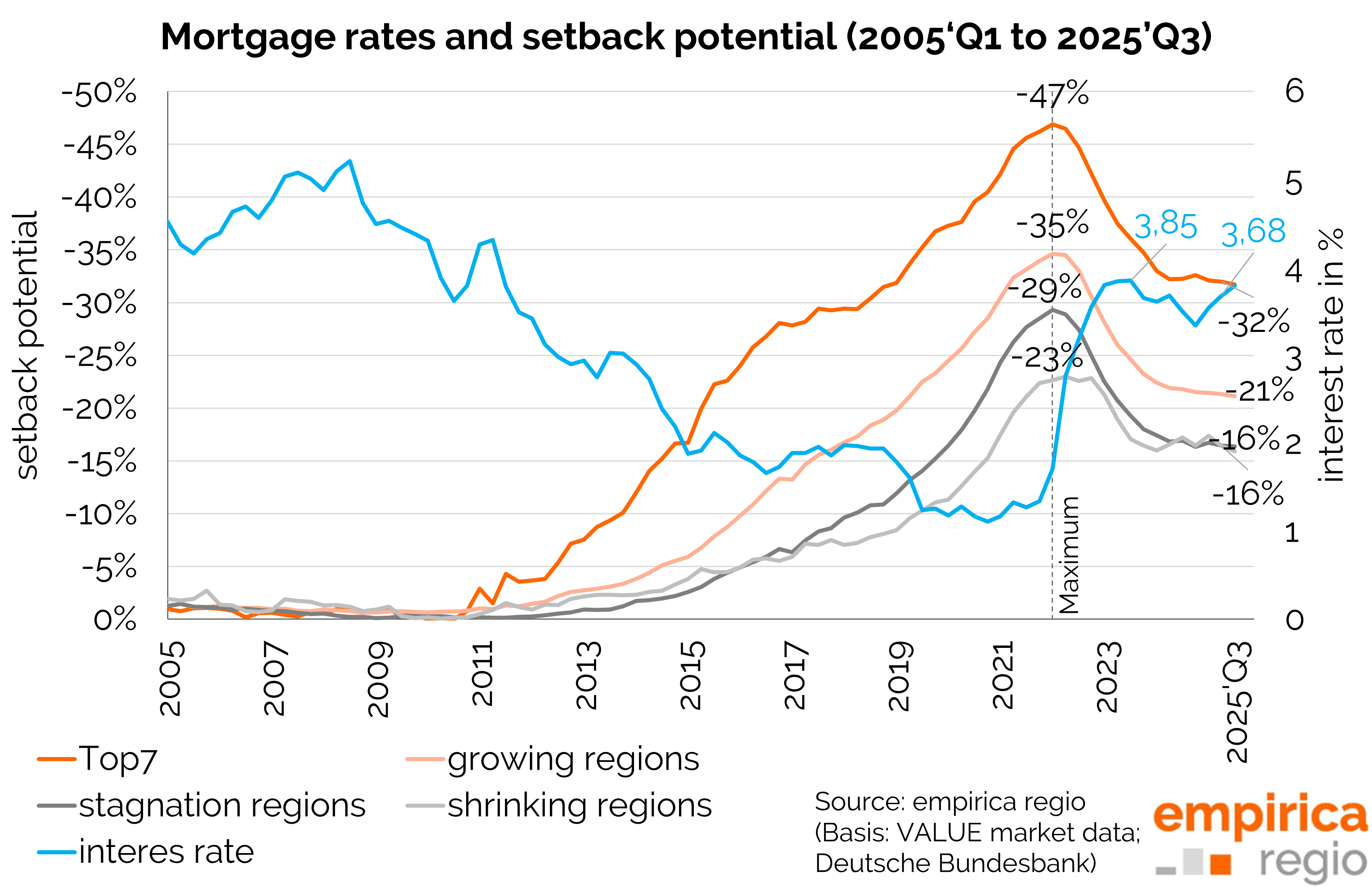

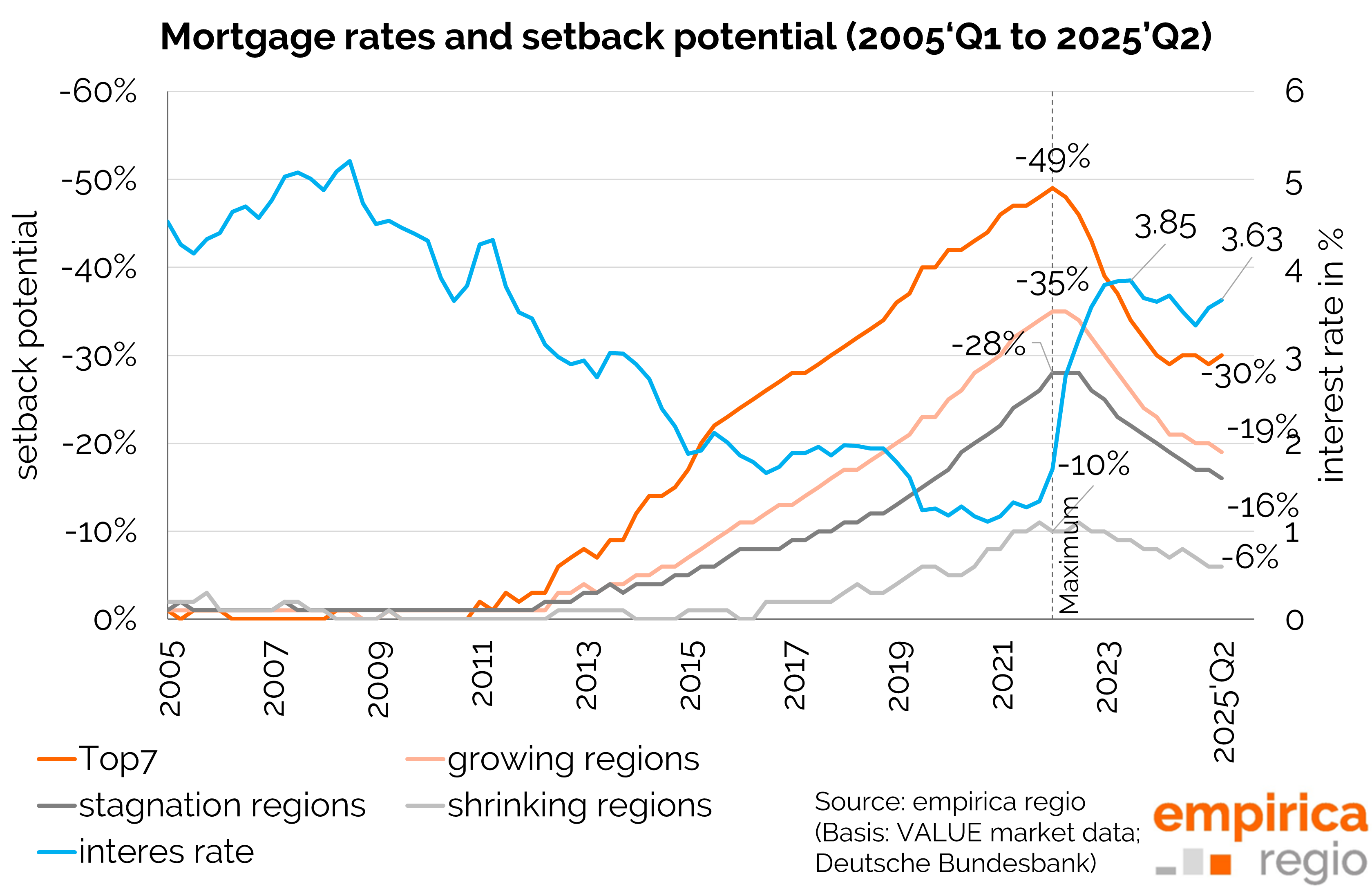

After rising for 11 years, the potential for a downturn, i.e. the relative price gap between purchase prices for owner-occupied flats and rents, has been falling nationwide since Q2 2022 and now stands at 20% (Q3 2024 also at 20%; three years ago at 31%). In all city and region types, the figures have been stagnating for four quarters or falling by a maximum of around 1 point. The trend towards lower potential for setbacks has been favoured by rising rents and falling purchase prices. However, the period of falling purchase prices is now likely to have come to an end in all city and region types.

Revision 2025

For Q3 2025, we have conducted a fundamental revision of the empirica housing market index , which also has an impact on the bubble index. In particular, this changes the multiplier and price-income sub-indices of the empirica bubble index. The new values are no longer comparable with the previous calculations. Therefore, the entire time series from 2005 onwards has been revised. Only these revised data should be used for temporal analyses.

Data basis empirica housing market bubble index

The empirica housing market bubble index is a quarterly index that assesses the risk of a property bubble in various regions of Germany. All data can be obtained as an individual dataset or via database access from empirica regio. Detailed results and further information on the methodology can be downloaded here: