Housing bubble index Q2/2025: Rent and price come together

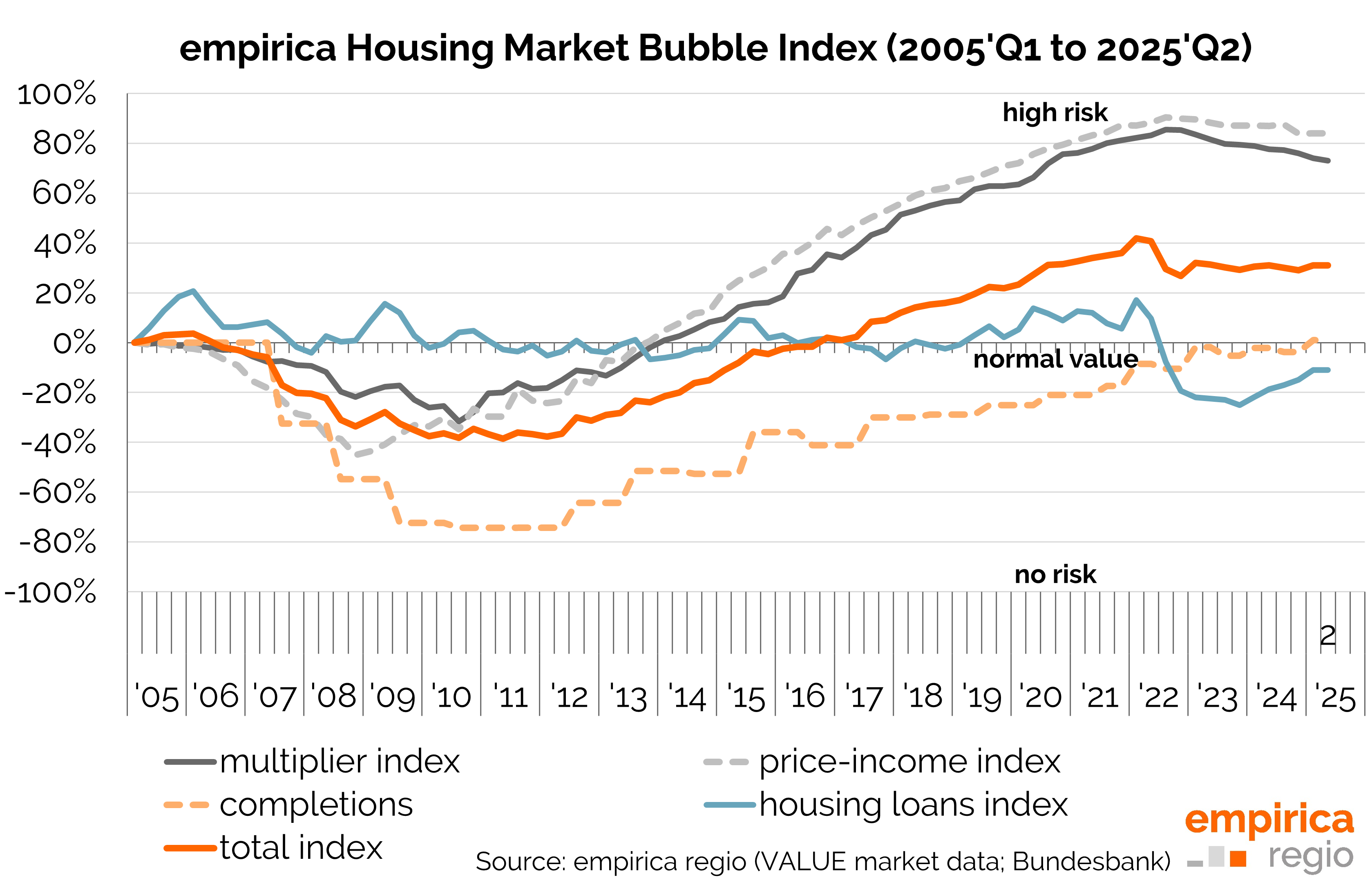

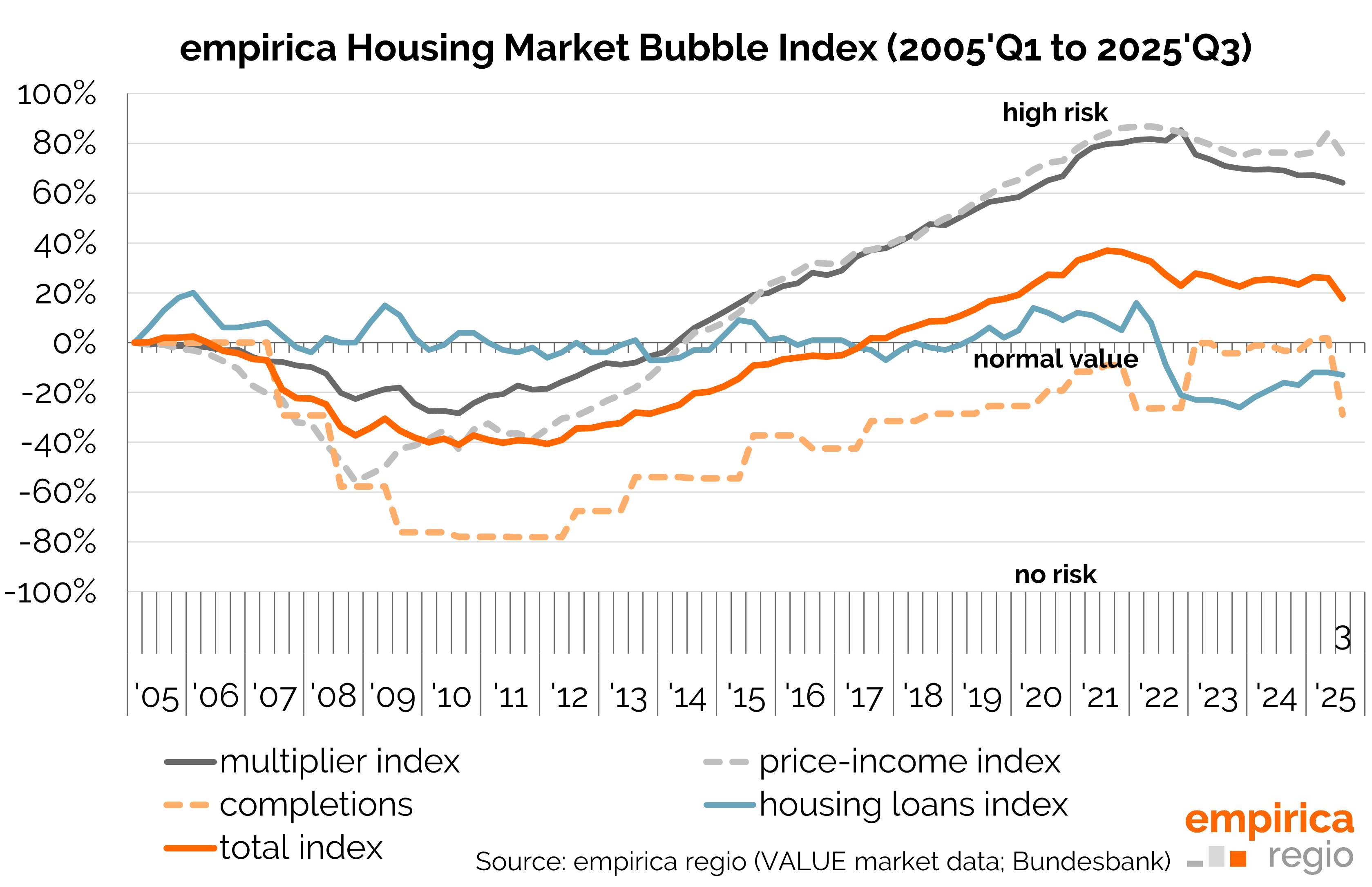

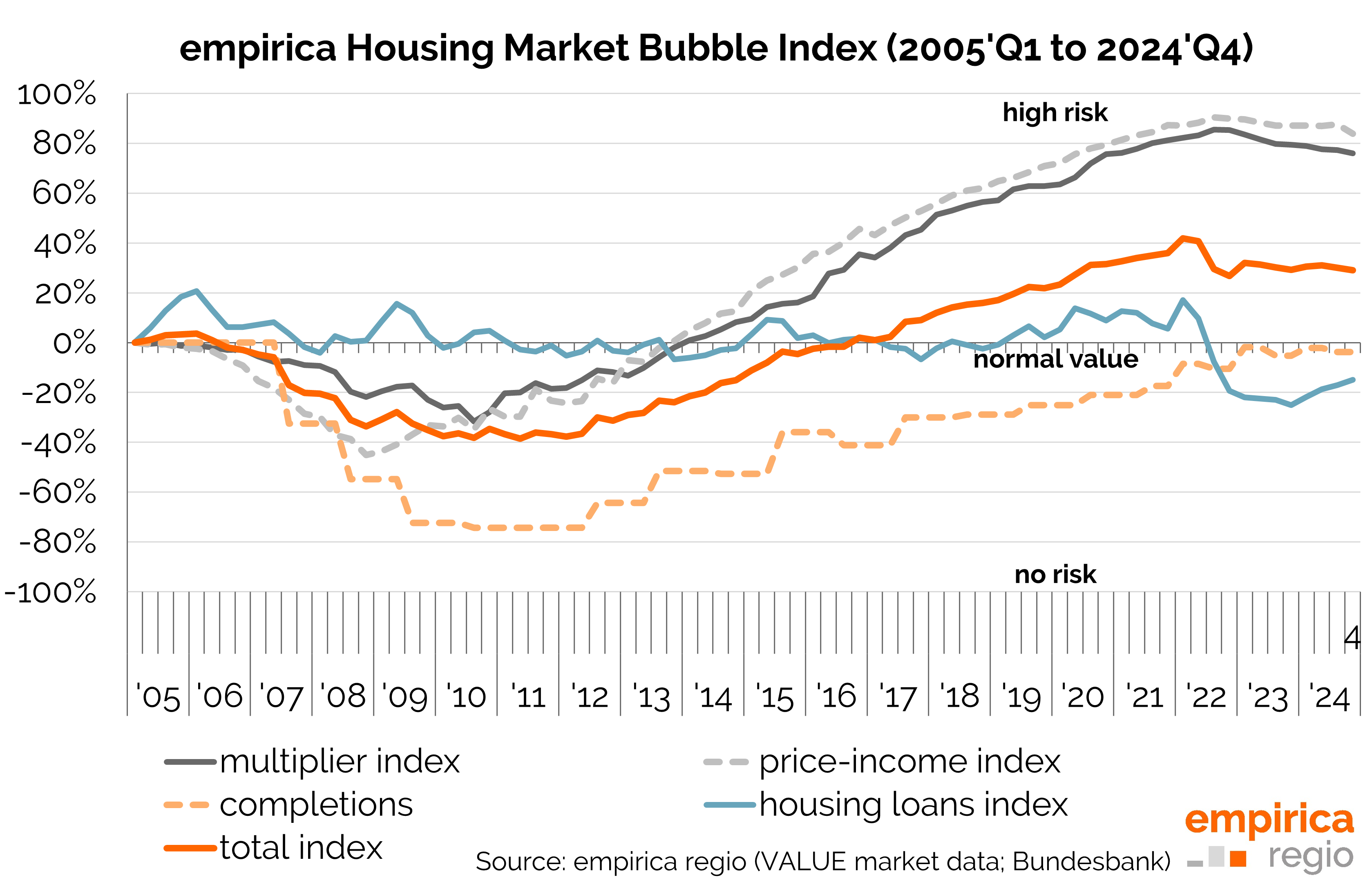

The empirica Housing Bubble Index shows the regional spread of a bubble risk. The multiplier sub-index (-1 point) has declined slightly. The sub-indices for construction loans, completions and price-income remain unchanged (+/-0 points).

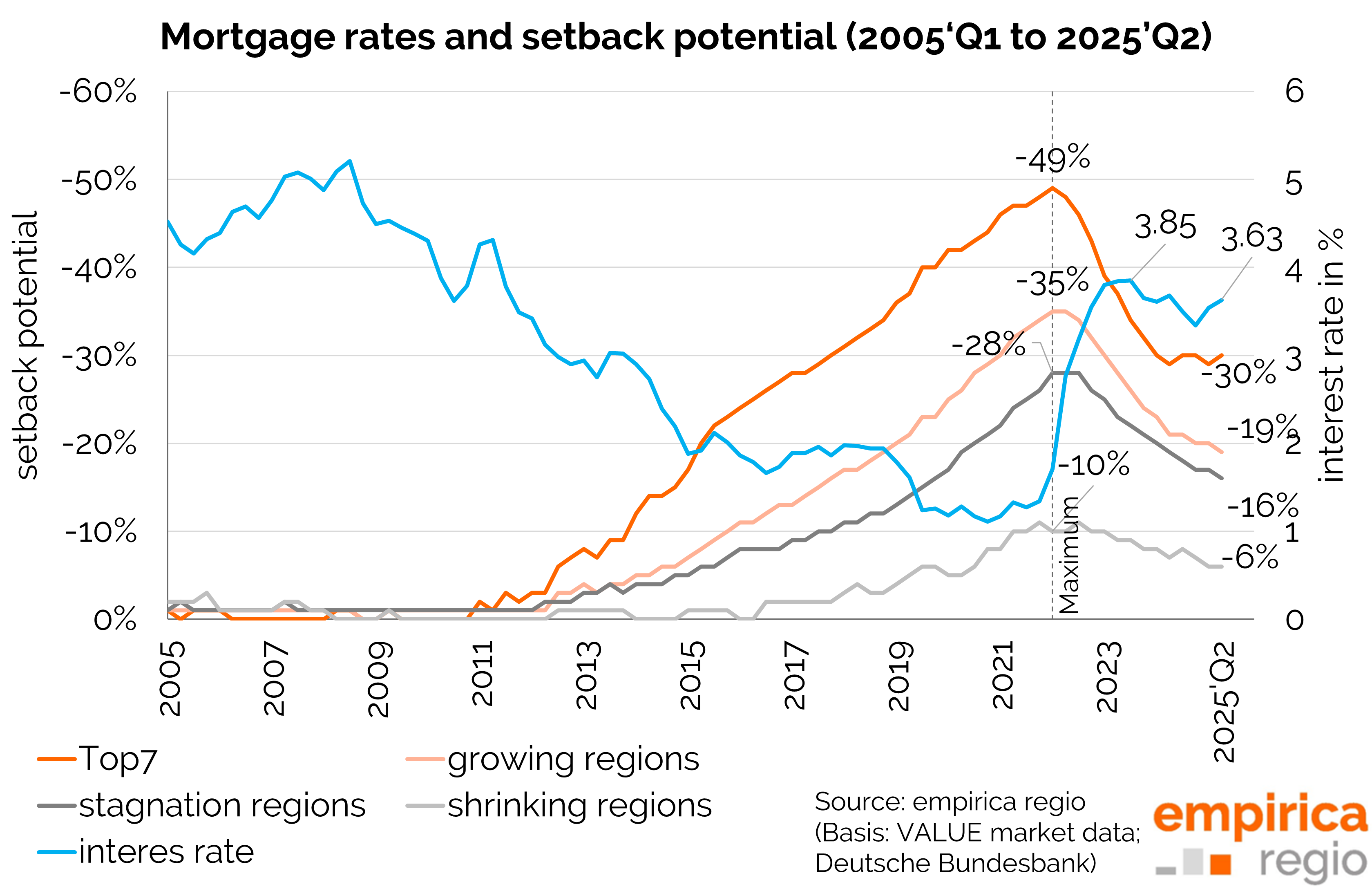

The rebound potential describes the relative price gap between purchase prices for condominiums and rents. After rising for 11 years, it has been falling nationwide since Q2 2022 and now stands at 18% (Q2 2024 still at 20%, three years ago at 32%). The decline was even more pronounced in the top 7 cities, where values have been stagnating for six quarters (Q2 2024 already at 29%, three years ago at 48%). The trend towards lower downside potential was favoured by rising rents and falling purchase prices. In the top seven cities, however, the period of falling purchase prices now seems to have come to an end. It remains to be seen, however, whether prices there will rise faster than rents again.

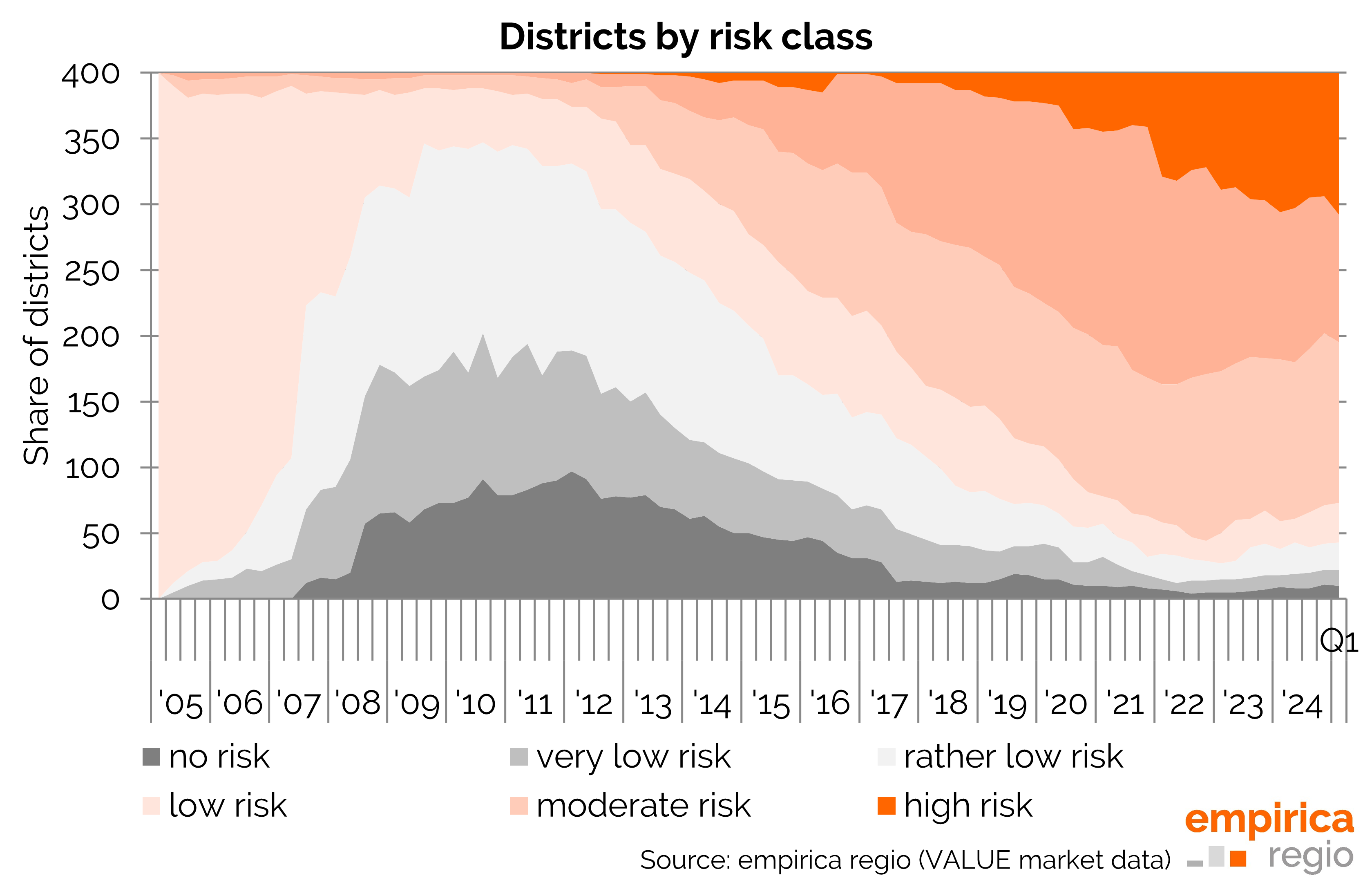

The empirica housing market bubble index is a quarterly index that assesses the risk of a property bubble in various regions of Germany. All data can be obtained as an individual dataset or via database access from empirica regio. Further results and information on the methodology can be downloaded from the empirica ag website: