Housing bubble index Q1/2025: Spread of bubble risk stagnates, but explosiveness continues to fall

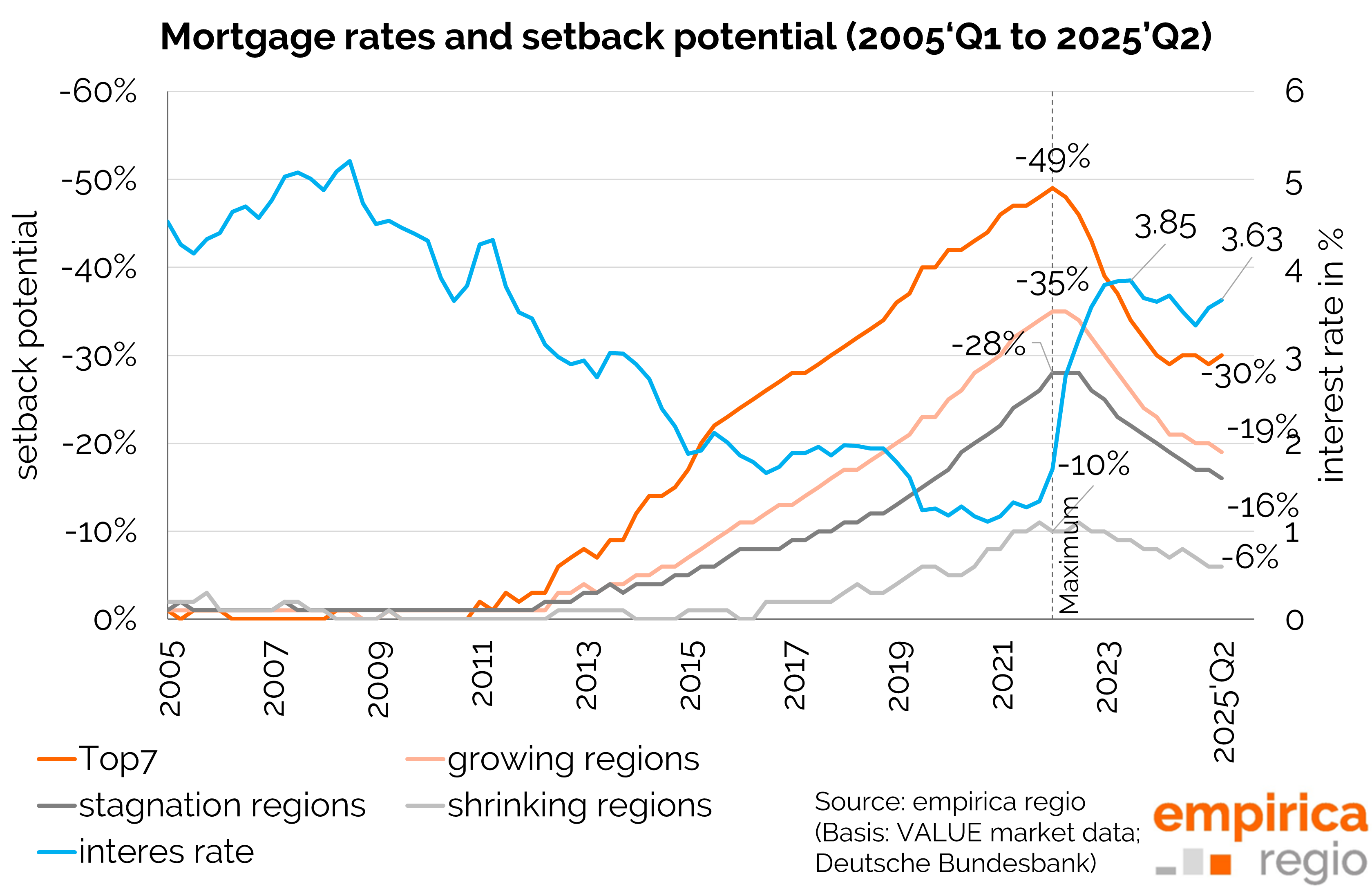

When rents rise faster than purchase prices, it gives hope to many who dream of owning their own home. This is because buying owner-occupied property is then more worthwhile than renting. At the same time, this trend acts as a safety net for the property market: the more rents catch up with purchase prices, the lower the risk of a price collapse - the risk of a bubble decreases.

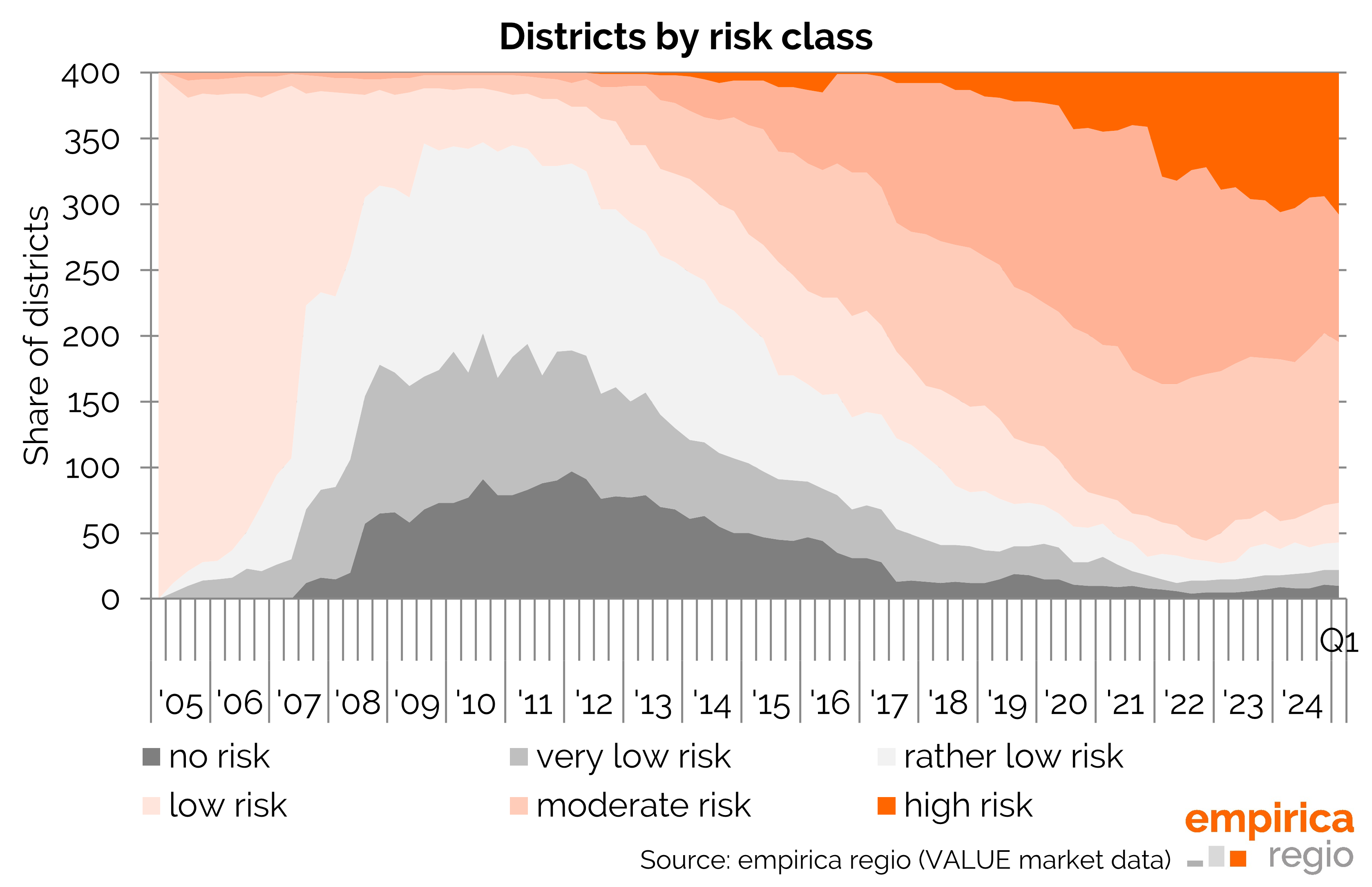

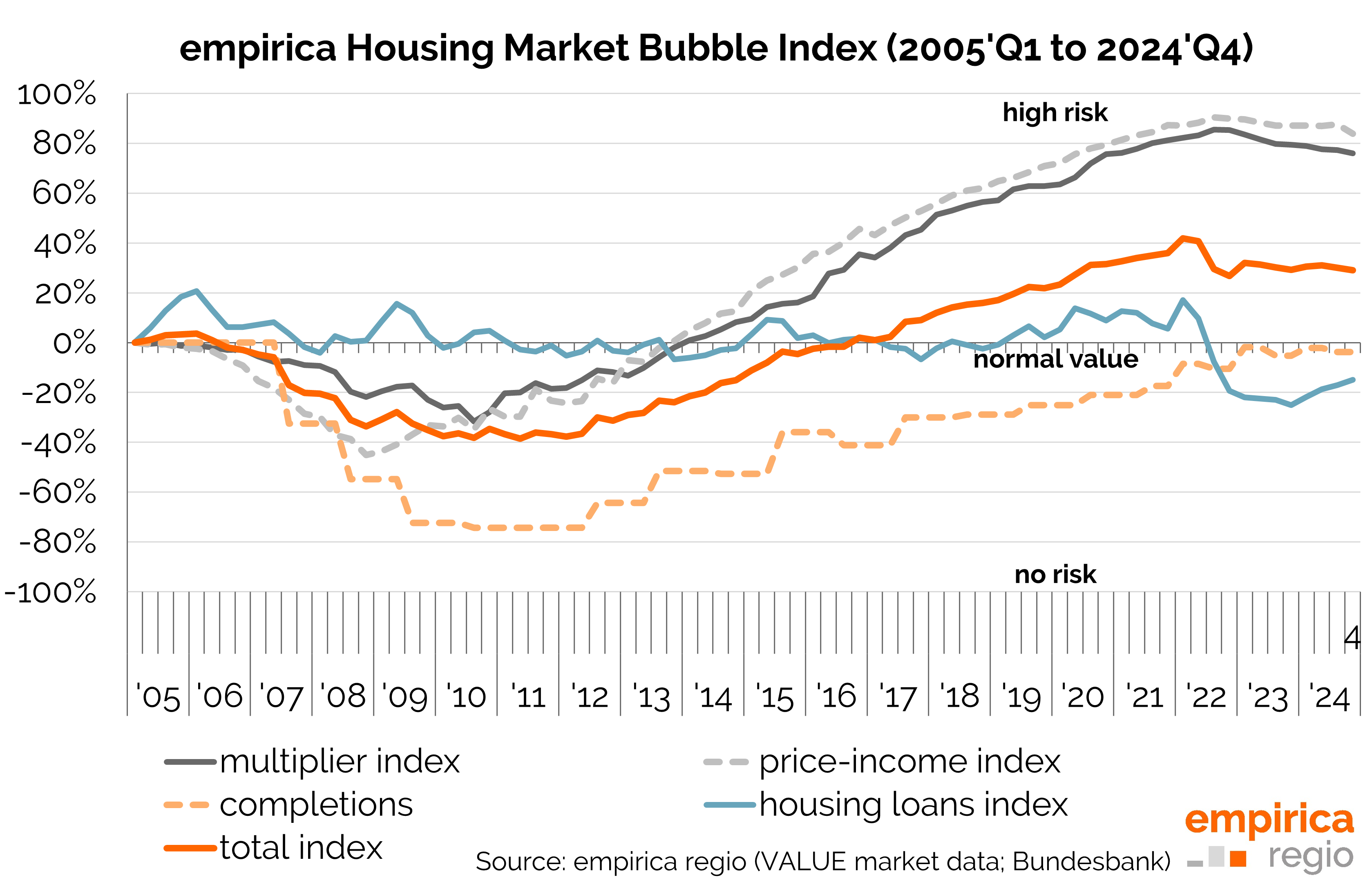

By 2022, however, the situation was tense. Purchase prices had moved far away from rents, favoured by years of low interest rates. A bubble seemed imminent. The turnaround came with the rise in interest rates: The pressure on prices grew. However, there has been no real fall in prices so far. The reason? Rents are rising noticeably, stabilising the price level.

The current trend reflects the expectation that living space will remain scarce - primarily because new construction is currently stalling. However, it is uncertain whether this shortage will persist in the long term. Demographic developments will be decisive. If there are no new waves of immigration from abroad, the increase in demand could slow down in a few years' time. Particularly in less attractive locations - both regional (macro locations) and urban (micro locations) - this could put prices under pressure again.

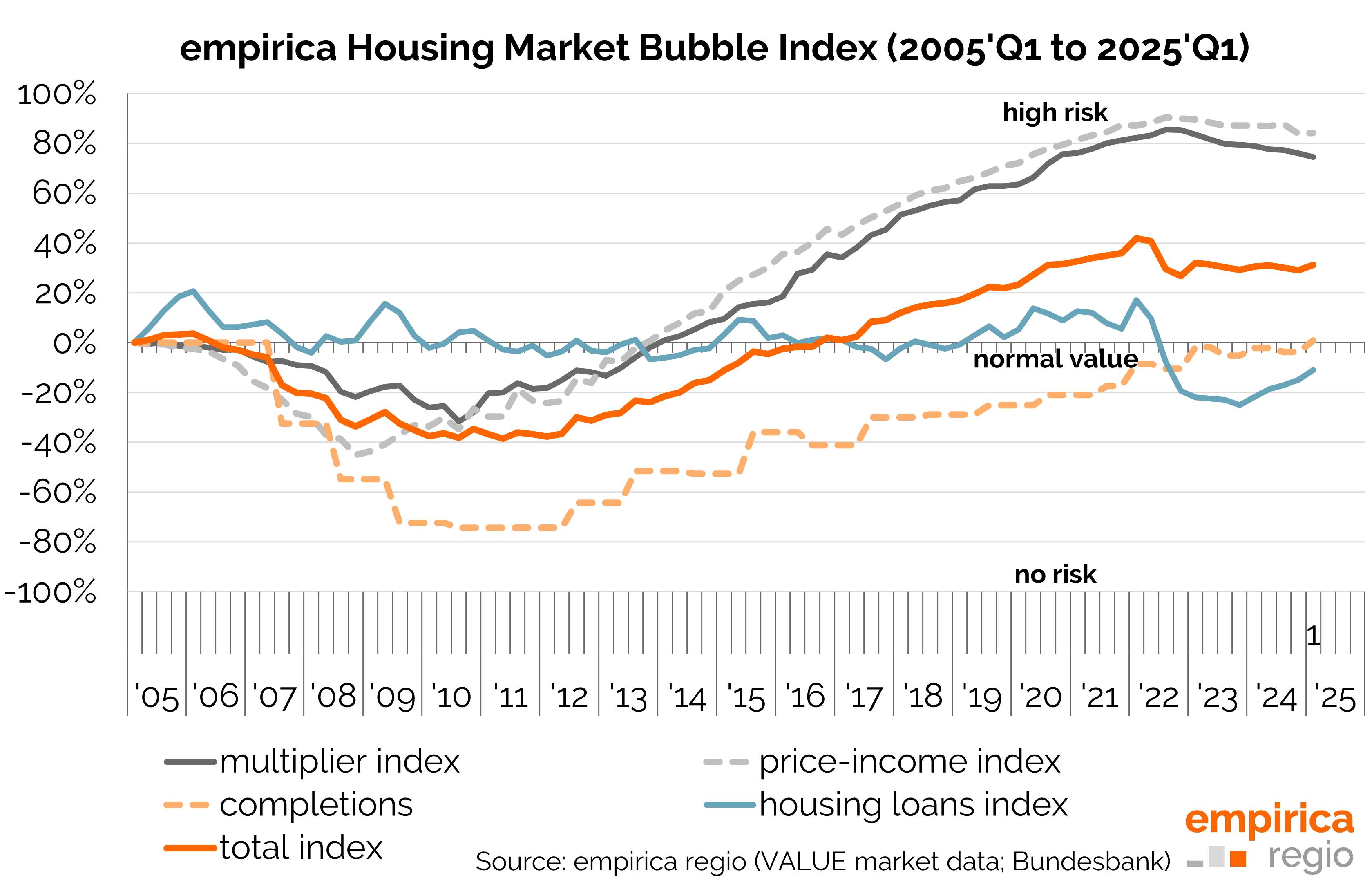

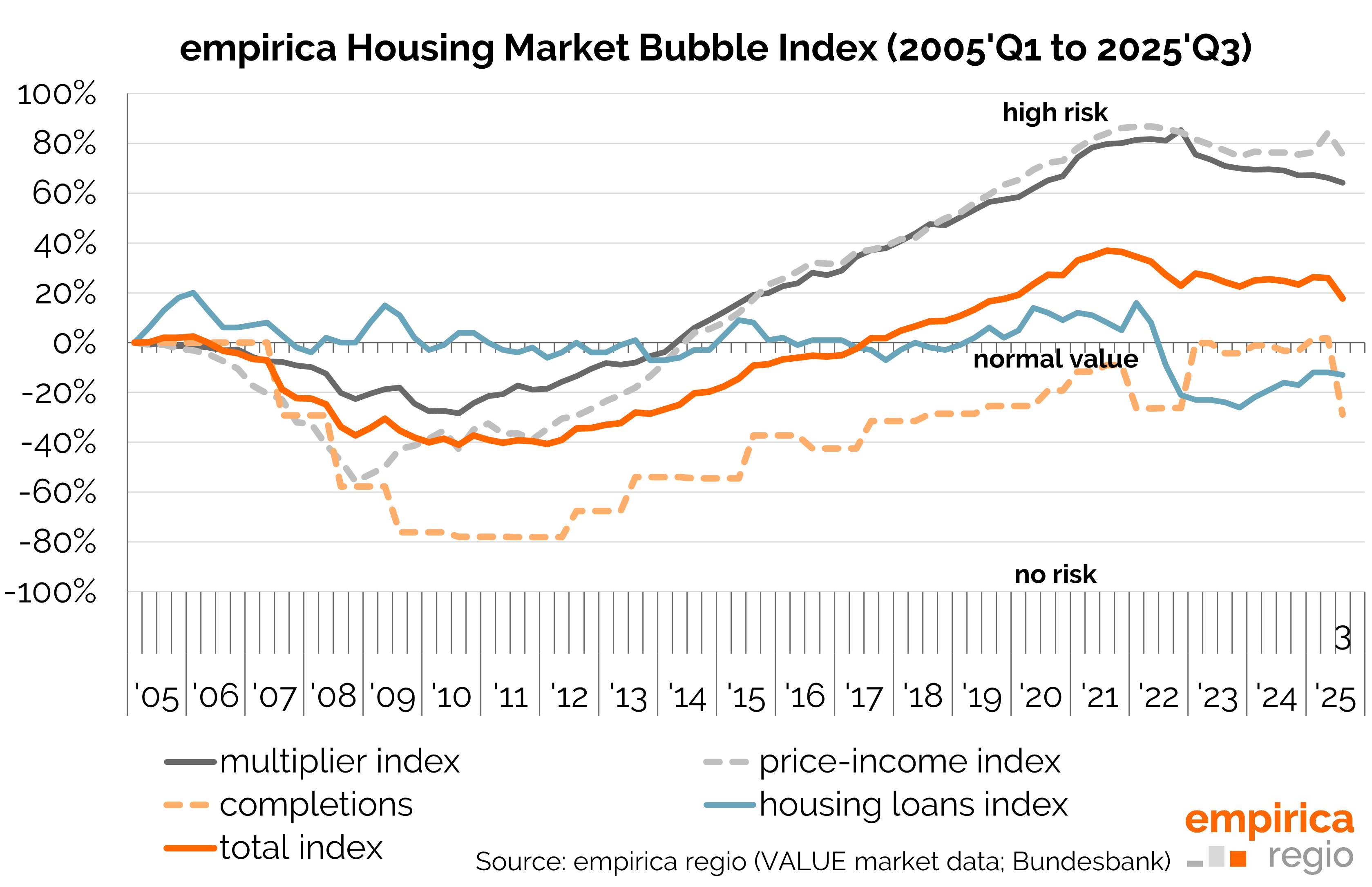

The multiplier sub-index (-1 pts.) fell slightly. By contrast, the sub-indices construction loans (+4 pts.) and completions (+5 pts.) rose slightly, while the price-income sub-index remained unchanged (+/-0 pts.)

The empirica housing market bubble index is a quarterly index that assesses the risk of a property bubble in various regions of Germany. All data can be obtained as an individual dataset or via database access from empirica regio. Further results and information on the methodology can be downloaded from the empirica ag website: